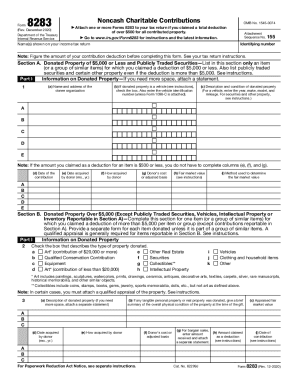

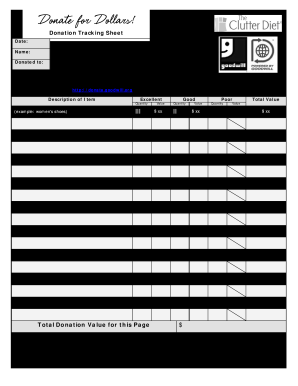

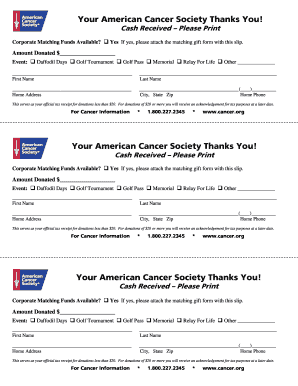

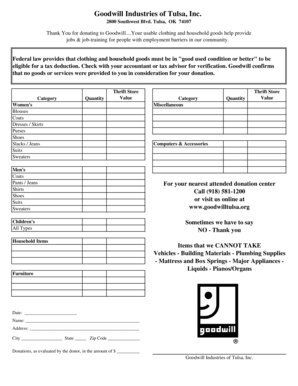

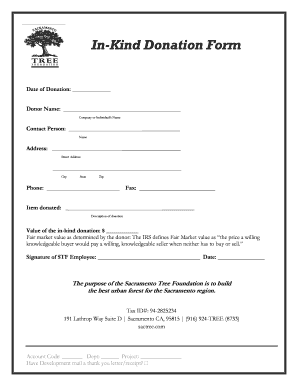

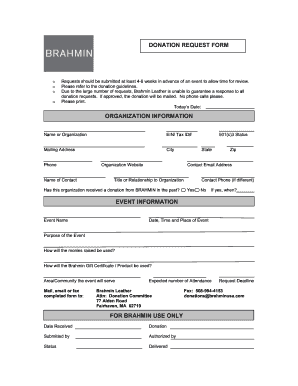

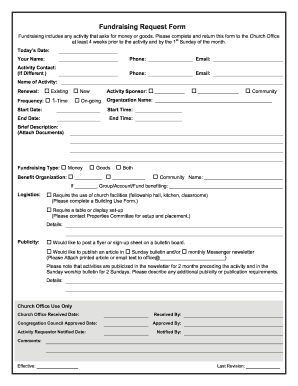

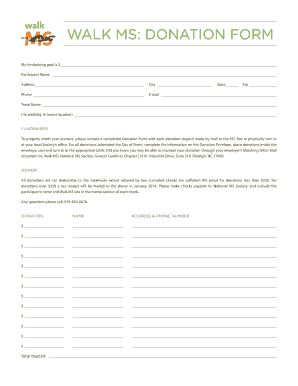

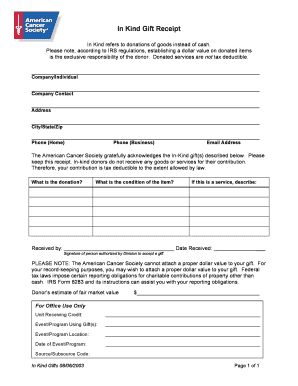

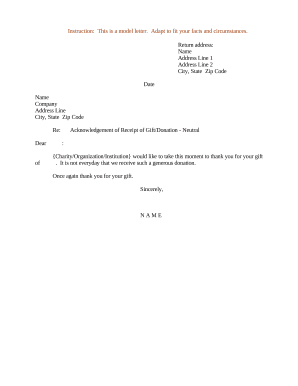

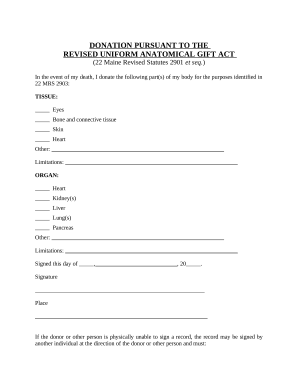

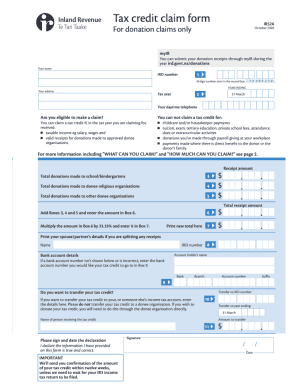

Remove the difficulty from donation forms with DocHub's web Non cash receipt in Donation Forms catalog. Easily modify, complete, and securely share forms with your supporters.

Your workflows always benefit when you can easily find all the forms and documents you will need at your fingertips. DocHub provides a a large collection forms to ease your everyday pains. Get hold of Non cash receipt in Donation Forms category and quickly find your document.

Start working with Non cash receipt in Donation Forms in a few clicks:

Enjoy smooth record management with DocHub. Check out our Non cash receipt in Donation Forms category and find your form today!