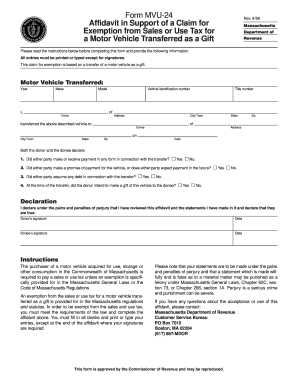

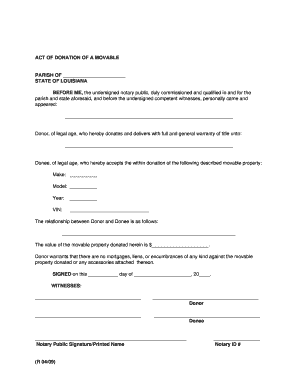

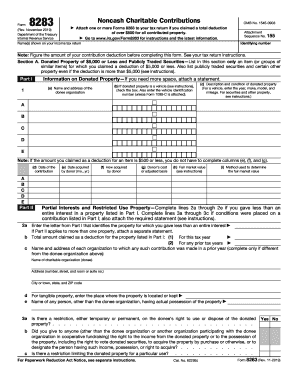

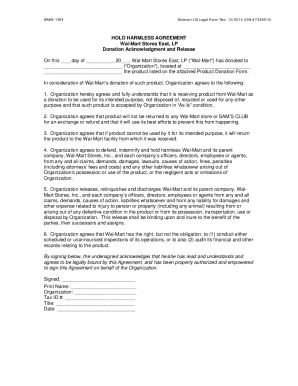

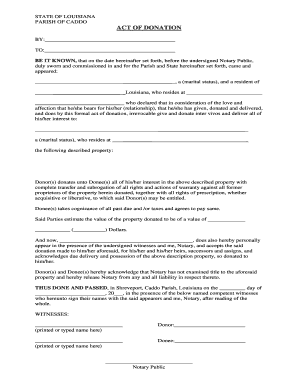

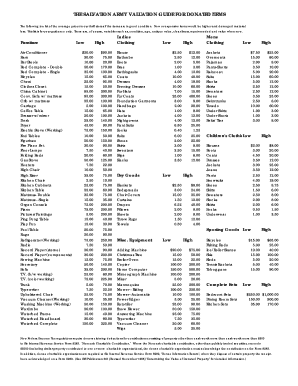

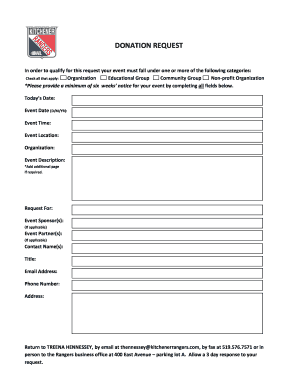

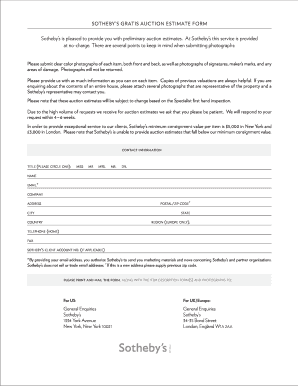

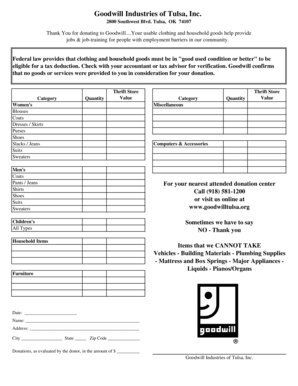

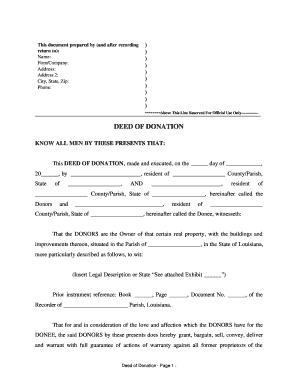

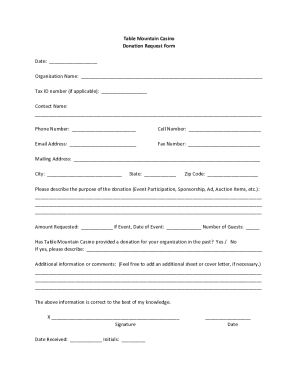

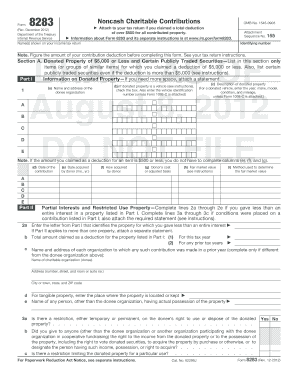

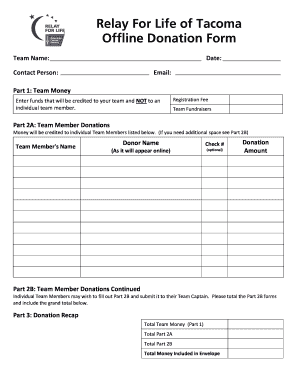

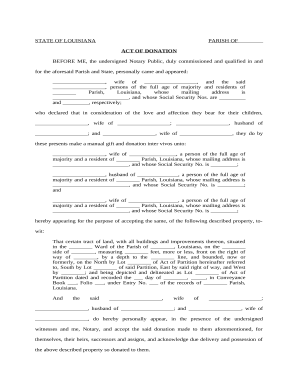

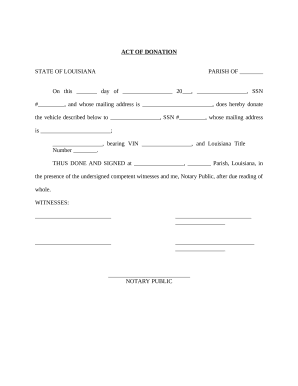

Remove the difficulty from donation forms with DocHub's web Item tax Donation Forms catalog. Effortlessly modify, fill out, and safely share forms with your donors.

Document managing can stress you when you can’t locate all the forms you require. Luckily, with DocHub's considerable form categories, you can get everything you need and easily handle it without changing among programs. Get our Item tax Donation Forms and begin working with them.

The best way to manage our Item tax Donation Forms using these basic steps:

Try out DocHub and browse our Item tax Donation Forms category without trouble. Get your free account right now!