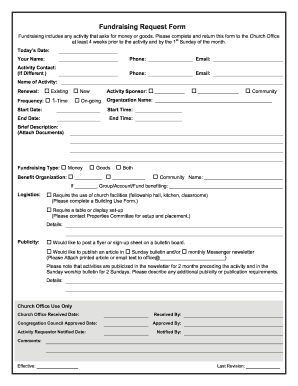

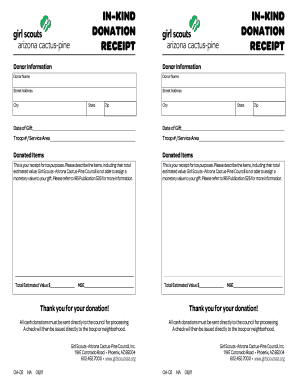

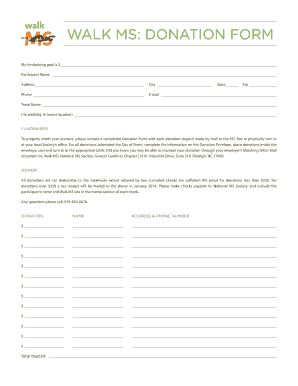

Simplify your document management with DocHub's Electronic receipt Donation Forms library. Easily edit, get information, and securely keep completed documents in your account.

Speed up your form operations using our Electronic receipt Donation Forms category with ready-made form templates that meet your requirements. Get the document, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to manage our Electronic receipt Donation Forms:

Examine all the opportunities for your online file management using our Electronic receipt Donation Forms. Get a free free DocHub profile today!