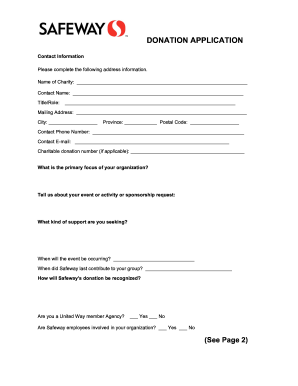

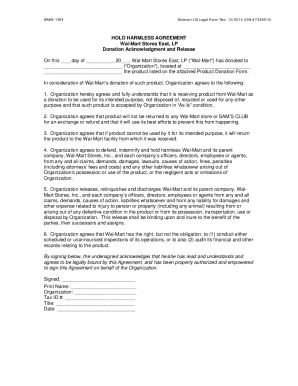

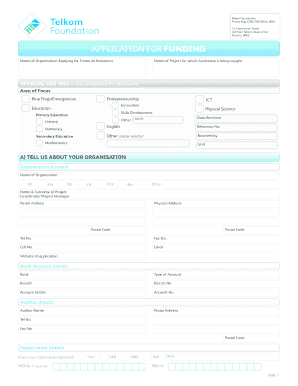

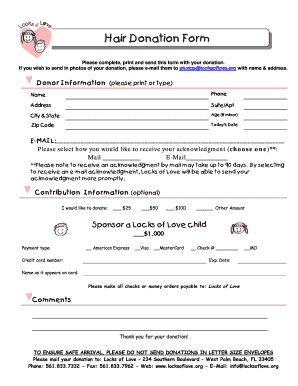

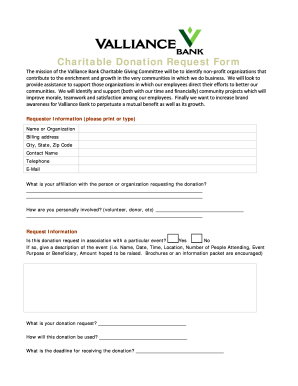

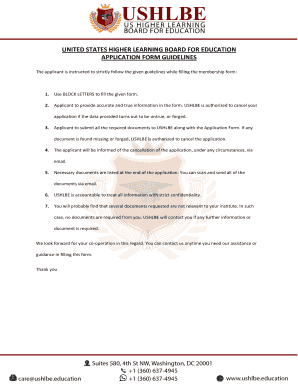

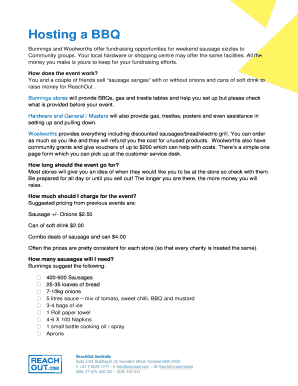

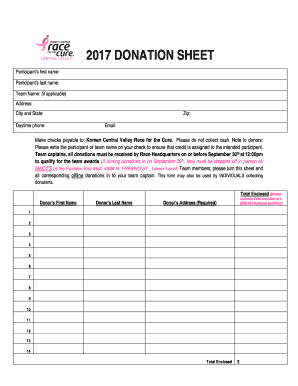

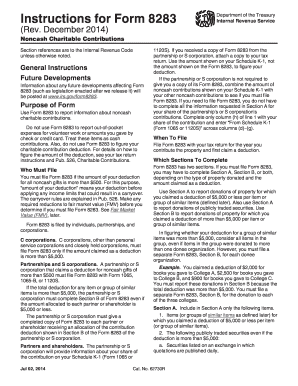

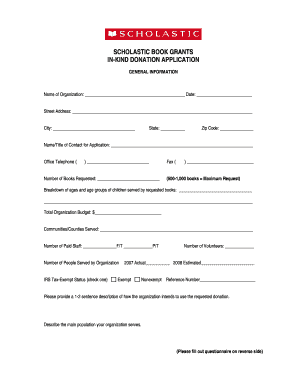

Make the fundraising efforts simpler with DocHub's Education non profit Donation Forms collection. Edit, fill out, and securely keep finished forms in your profile.

Document management can overpower you when you can’t locate all the documents you require. Luckily, with DocHub's substantial form categories, you can discover all you need and quickly handle it without changing between software. Get our Education non profit Donation Forms and start utilizing them.

Using our Education non profit Donation Forms using these simple steps:

Try out DocHub and browse our Education non profit Donation Forms category without trouble. Get your free account today!