Begin by accessing your DocHub account. Explore the pro DocHub functionality free for 30 days.

Once signed in, go to the DocHub dashboard. This is where you'll create your forms and handle your document workflow.

Hit New Document and choose Create Blank Document to be taken to the form builder.

Use the DocHub tools to insert and configure form fields like text areas, signature boxes, images, and others to your document.

Include needed text, such as questions or instructions, using the text tool to guide the users in your form.

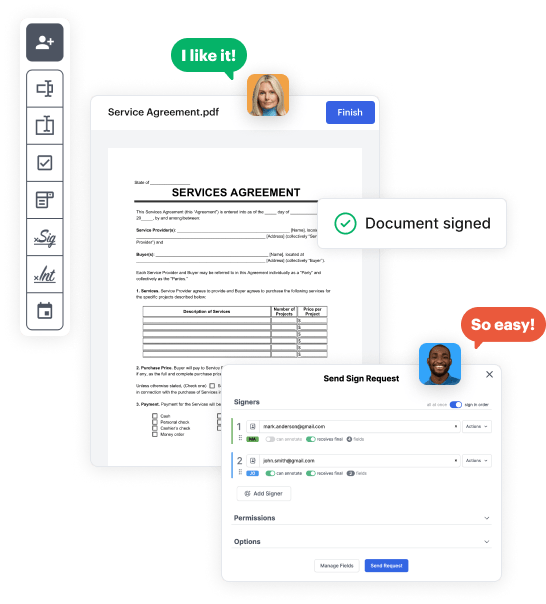

Modify the properties of each field, such as making them compulsory or arranging them according to the data you plan to collect. Designate recipients if applicable.

After you’ve managed to design the Church tax purposes Donation Form, make a final review of your document. Then, save the form within DocHub, export it to your preferred location, or distribute it via a link or email.