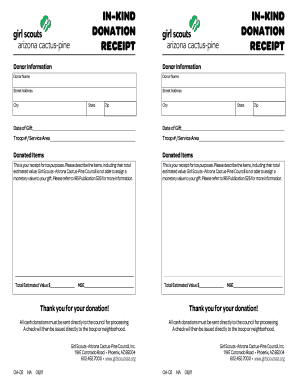

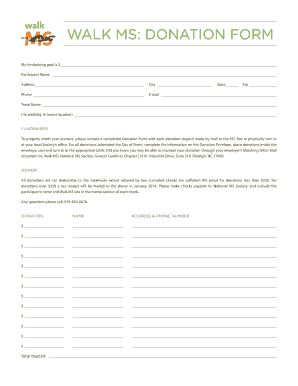

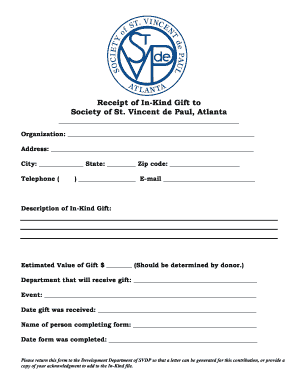

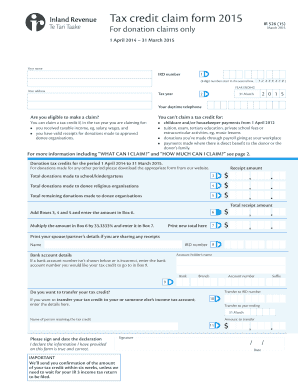

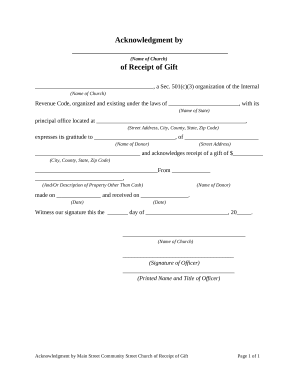

Explore Church receipt sheet Donation Forms and easily find appropriate templates. Enhance and improve the document organization procedures for your organization.

Your workflows always benefit when you can easily locate all of the forms and files you require at your fingertips. DocHub supplies a huge selection of documents to relieve your everyday pains. Get a hold of Church receipt sheet Donation Forms category and quickly find your form.

Start working with Church receipt sheet Donation Forms in a few clicks:

Enjoy effortless form management with DocHub. Discover our Church receipt sheet Donation Forms online library and find your form right now!