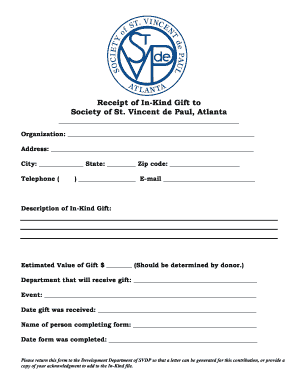

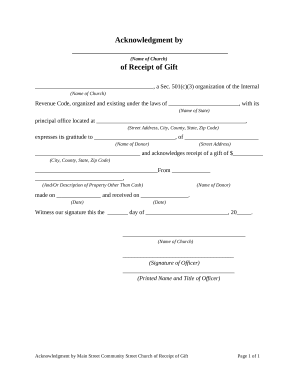

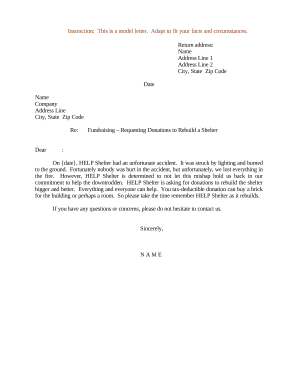

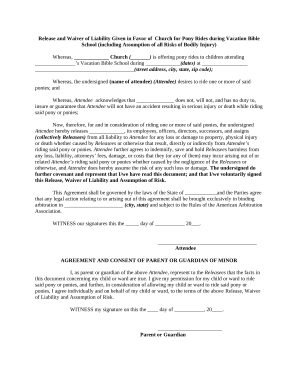

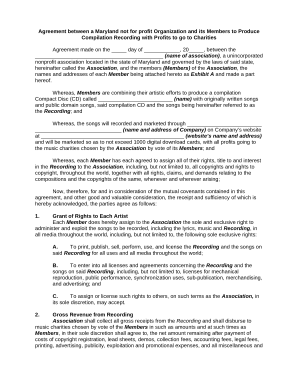

Remove the difficulty from donation forms with DocHub's online Church contribution statement year end receipt Donation Forms collection. Effortlessly adjust, complete, and safely send documents with your donors.

Improve your file administration with the Church contribution statement year end receipt Donation Forms category with ready-made templates that suit your needs. Access your document template, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to manage our Church contribution statement year end receipt Donation Forms:

Discover all the possibilities for your online document administration with the Church contribution statement year end receipt Donation Forms. Get a free free DocHub account today!