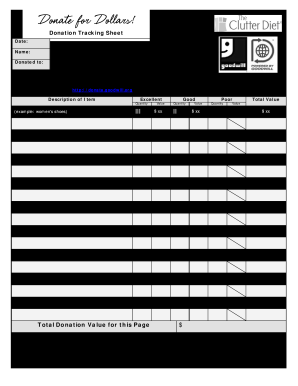

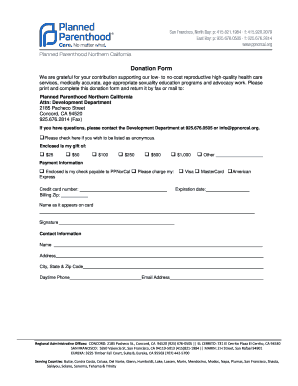

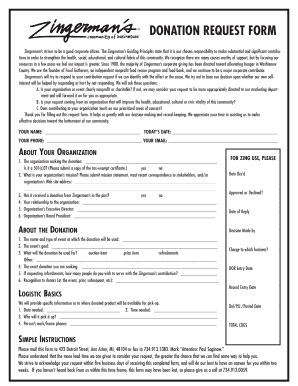

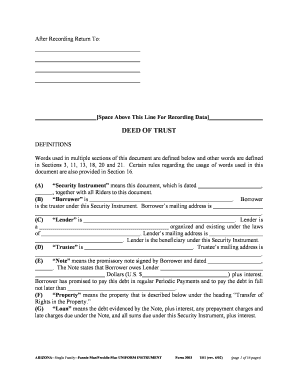

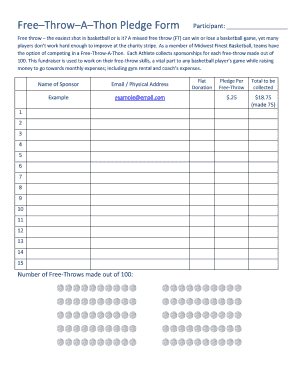

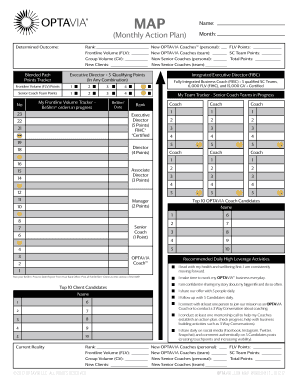

Simplify your document management with DocHub's Charitable tracker Donation Forms library. Effortlessly modify, gather data, and safely store completed documents in your profile.

Accelerate your form management with the Charitable tracker Donation Forms library with ready-made templates that suit your requirements. Get your form template, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently together with your documents.

The best way to use our Charitable tracker Donation Forms:

Examine all of the possibilities for your online document administration using our Charitable tracker Donation Forms. Get your free free DocHub profile today!