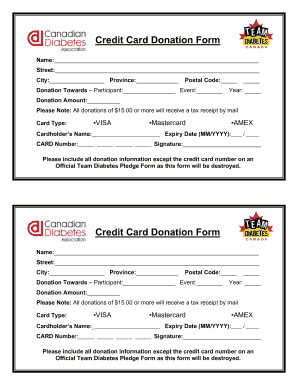

Access modifiable Budgets Donation Forms catalog and find the form you require. Complete, sign, and send documents with ease using DocHub.

Your workflows always benefit when you can easily get all the forms and documents you may need at your fingertips. DocHub delivers a a huge library of documents to relieve your everyday pains. Get hold of Budgets Donation Forms category and easily discover your form.

Start working with Budgets Donation Forms in several clicks:

Enjoy smooth file managing with DocHub. Explore our Budgets Donation Forms online library and look for your form right now!