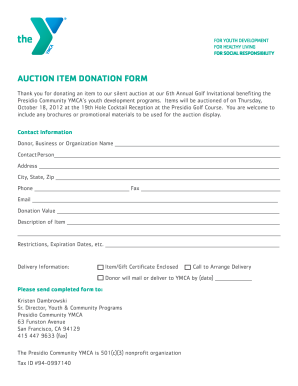

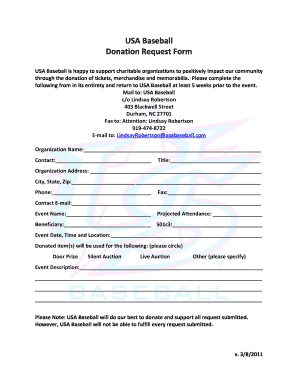

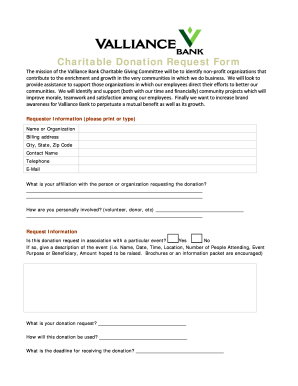

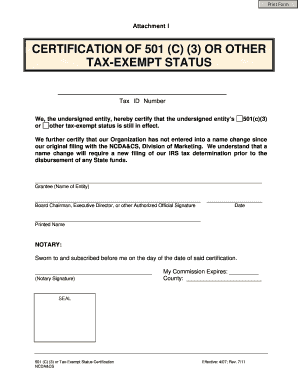

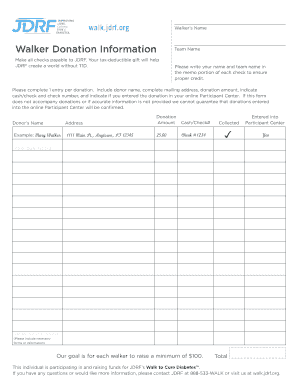

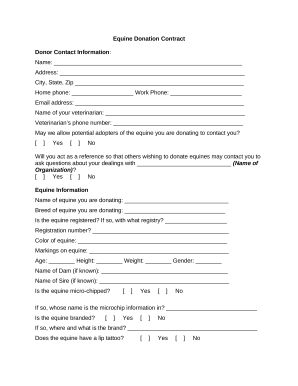

Enhance your fundraising efforts with DocHub's modifiable 501(c)(3) statement Donation Forms templates. Make a lasting impression on donors with professional and customized donation forms.

Your workflows always benefit when you are able to find all the forms and documents you may need at your fingertips. DocHub provides a vast array of templates to ease your day-to-day pains. Get a hold of 501(c)(3) statement Donation Forms category and quickly find your document.

Start working with 501(c)(3) statement Donation Forms in a few clicks:

Enjoy smooth record administration with DocHub. Discover our 501(c)(3) statement Donation Forms online library and locate your form right now!