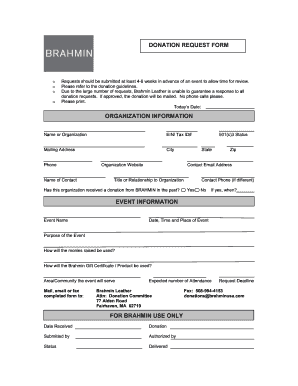

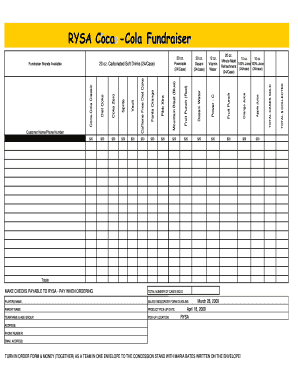

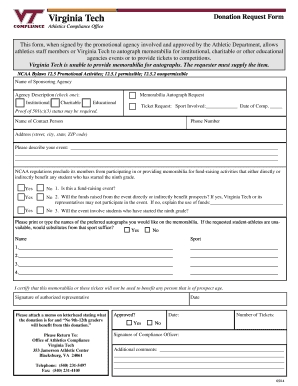

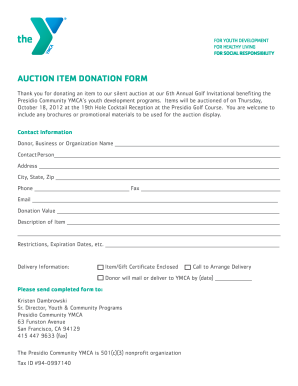

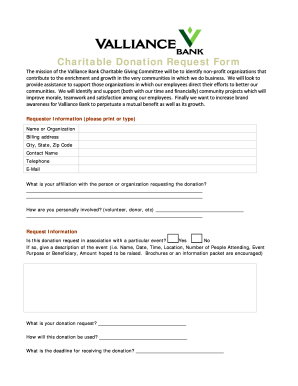

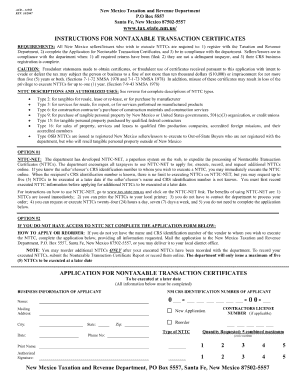

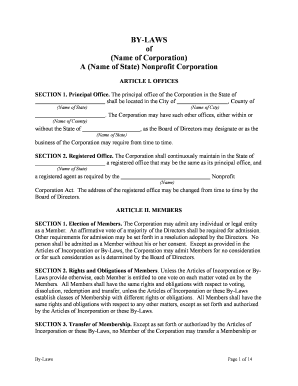

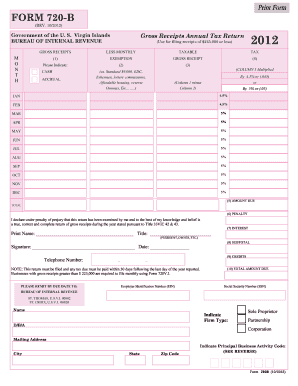

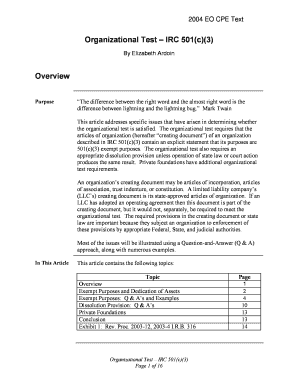

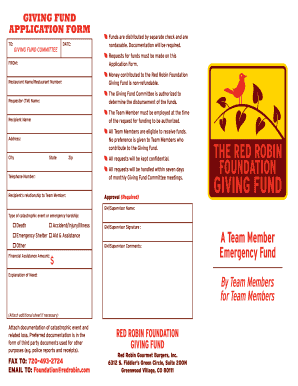

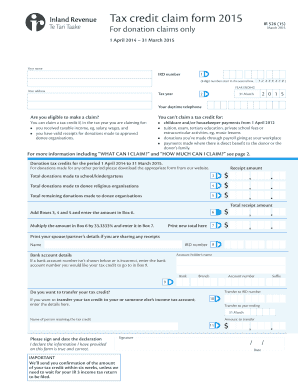

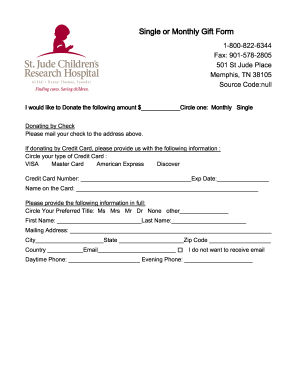

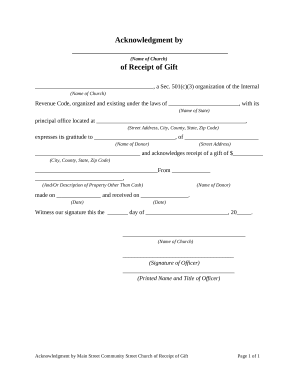

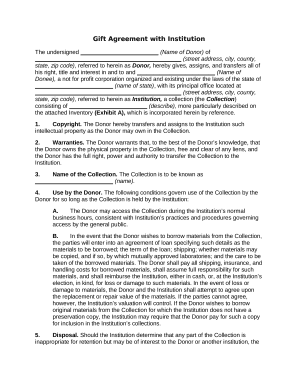

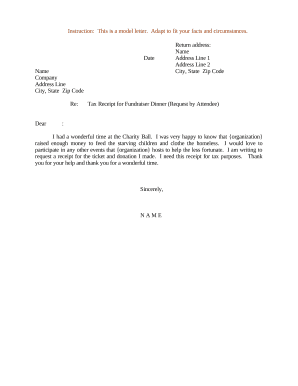

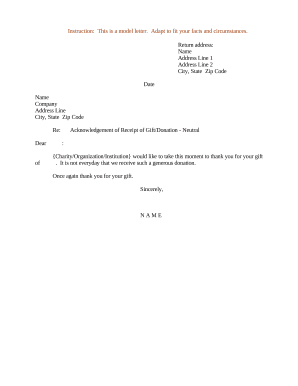

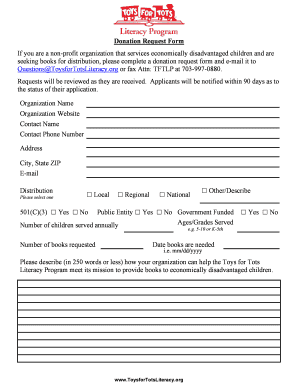

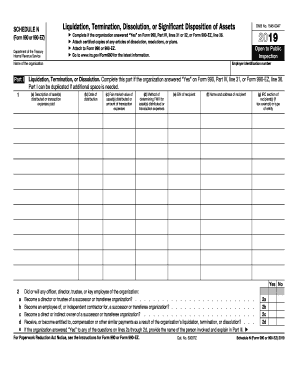

Find relevant forms with our 501c receipt Donation Forms catalog. Ensure a compliant document management process with DocHub's powerful document editing features.

Document management can overwhelm you when you can’t find all the documents you require. Luckily, with DocHub's substantial form collection, you can discover all you need and quickly take care of it without the need of switching among software. Get our 501c receipt Donation Forms and begin utilizing them.

Using our 501c receipt Donation Forms using these easy steps:

Try out DocHub and browse our 501c receipt Donation Forms category easily. Get a free account today!