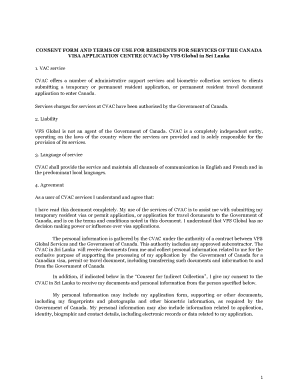

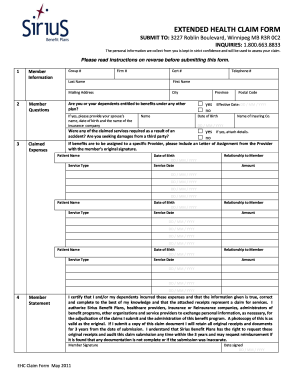

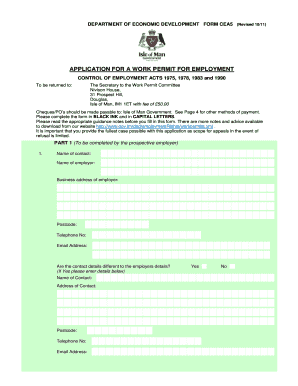

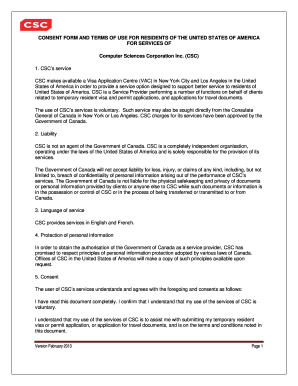

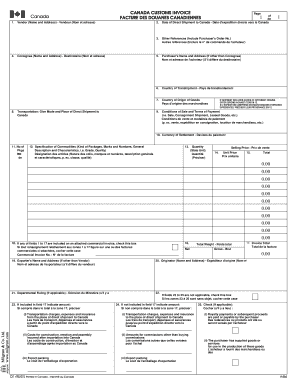

Enhance your common workflows with Terms of use Canada Forms. Find, edit, and share forms online with DocHub extensive document management features.

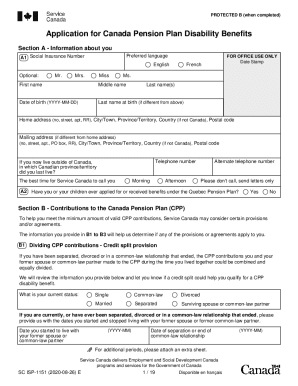

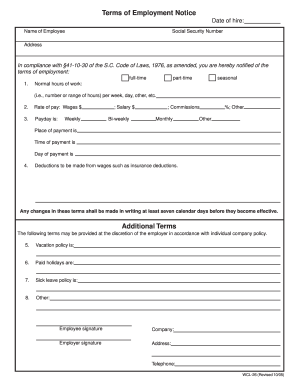

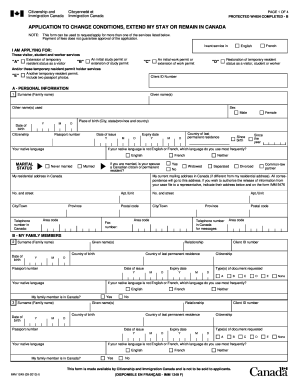

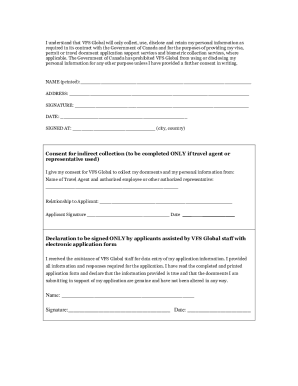

Your workflows always benefit when you can easily obtain all the forms and documents you may need at your fingertips. DocHub delivers a a huge library of documents to relieve your daily pains. Get a hold of Terms of use Canada Forms category and quickly browse for your document.

Begin working with Terms of use Canada Forms in several clicks:

Enjoy fast and easy record managing with DocHub. Check out our Terms of use Canada Forms collection and get your form right now!