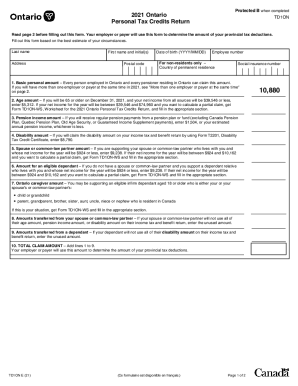

Discover our Personal financial statement Canada Forms library and find the right template online. Save time and effort by managing your forms with DocHub flexible tools.

Improve your document management with our Personal financial statement Canada Forms category with ready-made templates that suit your requirements. Get your form, change it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your forms.

The best way to manage our Personal financial statement Canada Forms:

Explore all the opportunities for your online file management with our Personal financial statement Canada Forms. Get a free free DocHub profile today!