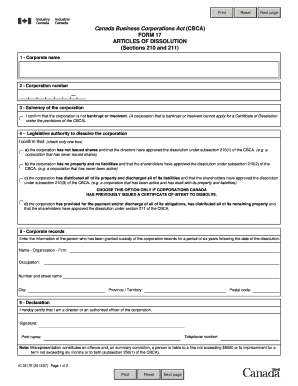

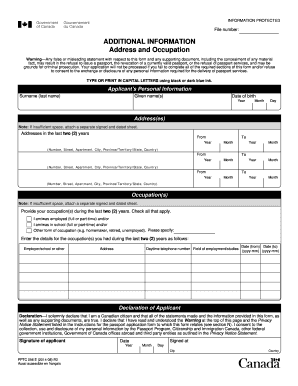

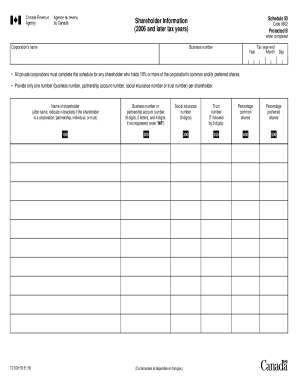

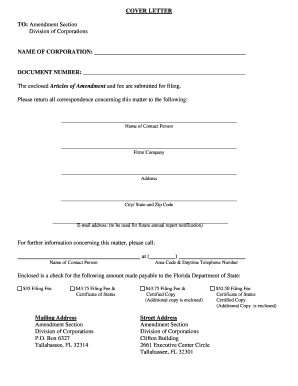

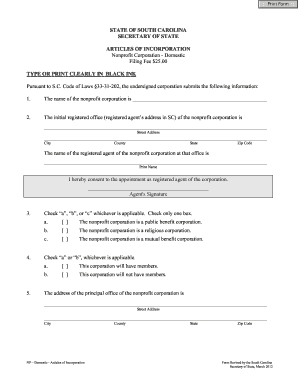

Access relevant Nonprofit corporation Canada Forms and easily control them according to your requirements. Edit, fill out, and securely send your documents with local officials.

Record administration consumes to half of your business hours. With DocHub, it is possible to reclaim your time and enhance your team's efficiency. Get Nonprofit corporation Canada Forms category and investigate all templates relevant to your everyday workflows.

The best way to use Nonprofit corporation Canada Forms:

Speed up your everyday document administration with our Nonprofit corporation Canada Forms. Get your free DocHub account right now to discover all forms.