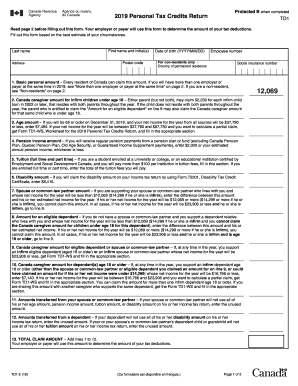

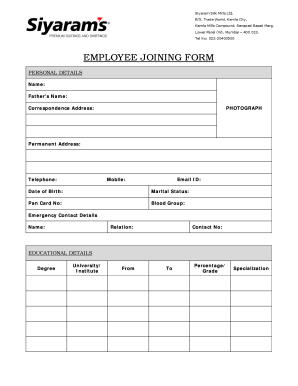

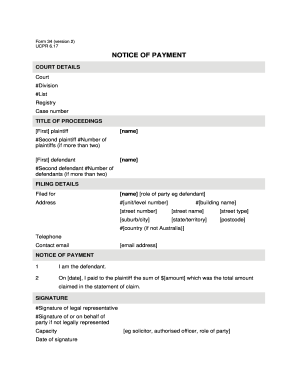

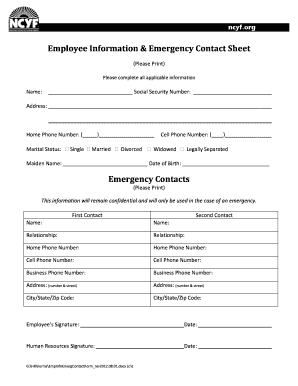

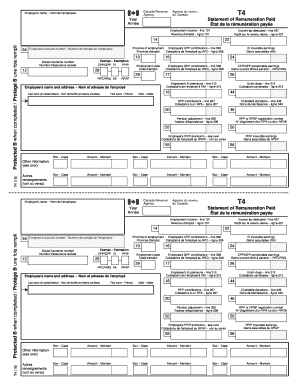

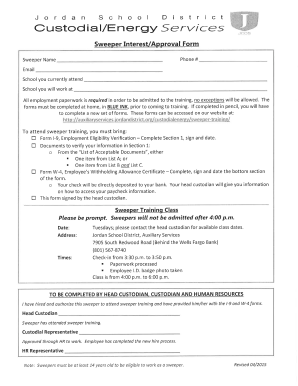

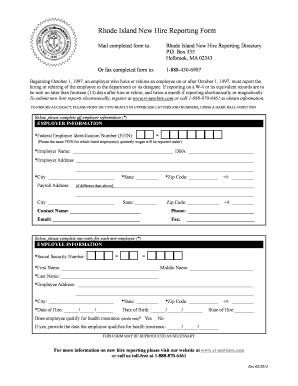

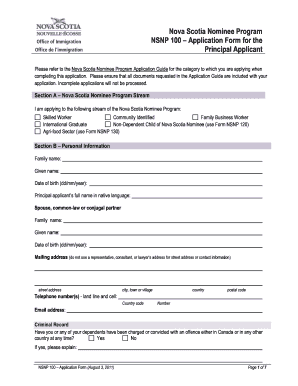

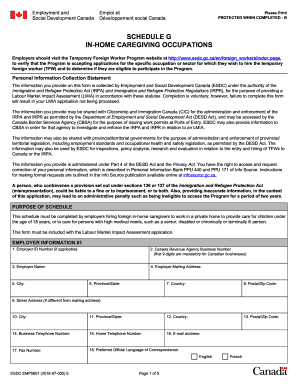

Remain compliant with the latest regulations and effortlessly modify New hire Canada Forms online. Access, complete, and sign your forms with DocHub easily.

Papers management takes up to half of your business hours. With DocHub, you can reclaim your time and effort and increase your team's productivity. Get New hire Canada Forms online library and explore all form templates related to your daily workflows.

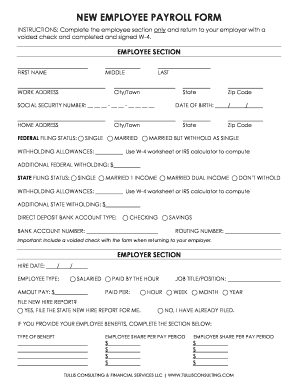

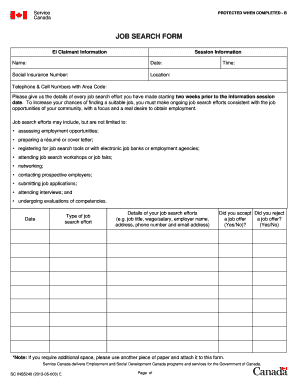

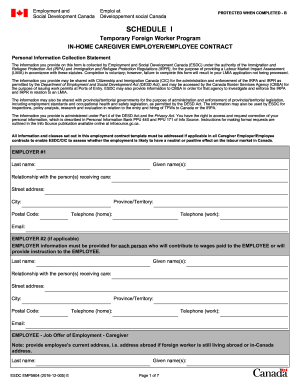

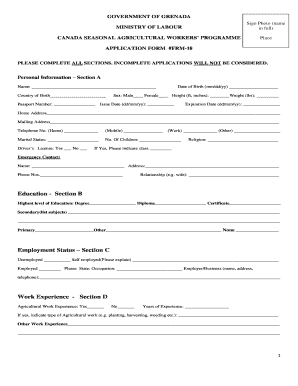

Easily use New hire Canada Forms:

Boost your daily file management using our New hire Canada Forms. Get your free DocHub account today to explore all templates.