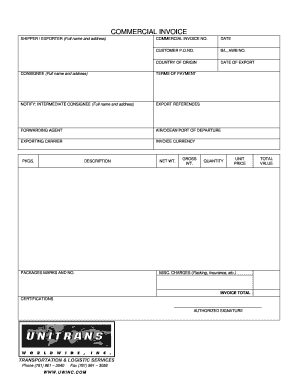

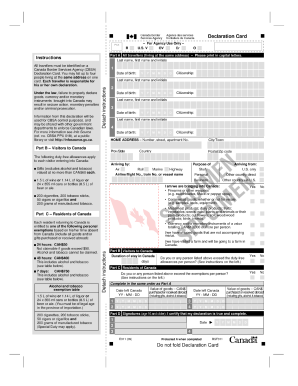

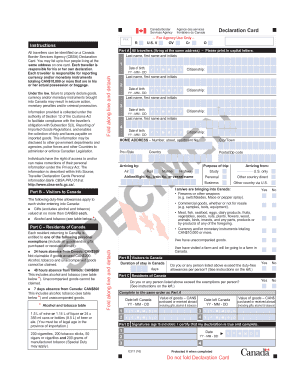

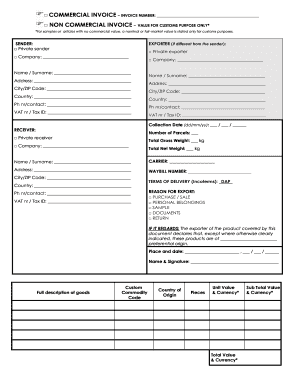

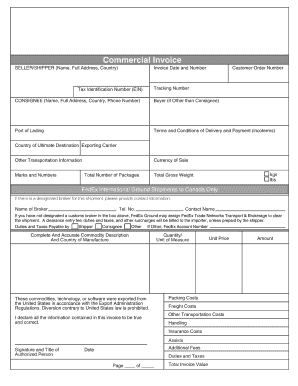

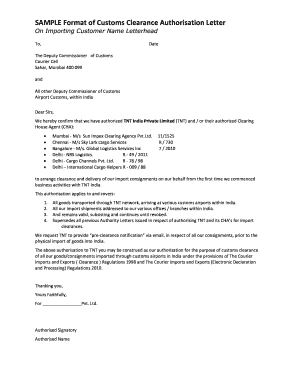

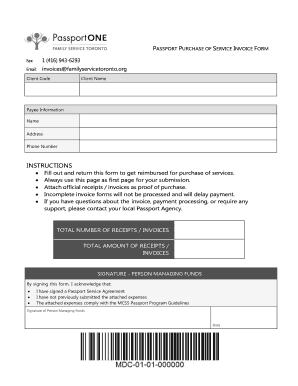

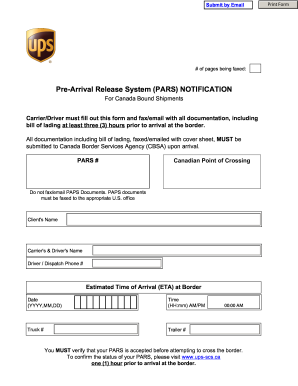

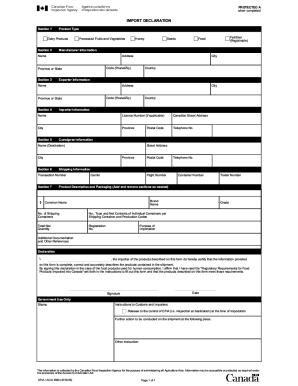

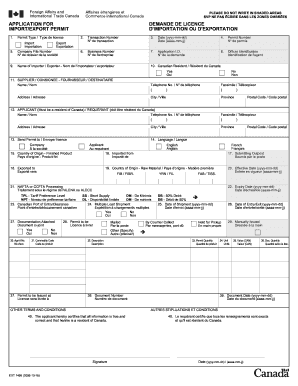

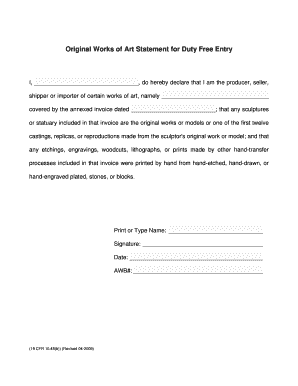

Easily navigate Customs commercial invoice Canada Forms and manage your documents within your DocHub profile. Streamline your frequent document workflows, adjust and fill out documents online, and securely share them with others.

Document management can overpower you when you can’t find all the forms you require. Luckily, with DocHub's substantial form categories, you can get all you need and quickly handle it without switching between apps. Get our Customs commercial invoice Canada Forms and start utilizing them.

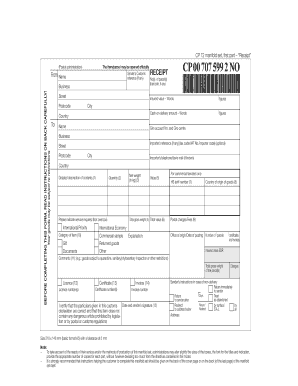

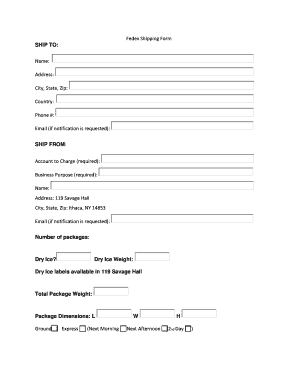

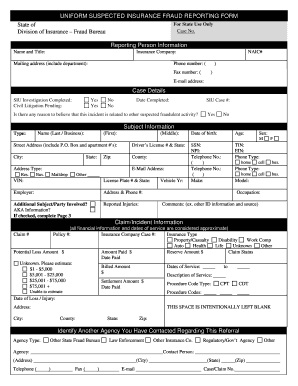

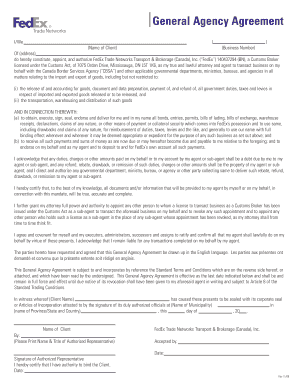

The best way to manage our Customs commercial invoice Canada Forms using these simple steps:

Try out DocHub and browse our Customs commercial invoice Canada Forms category with ease. Get a free profile right now!