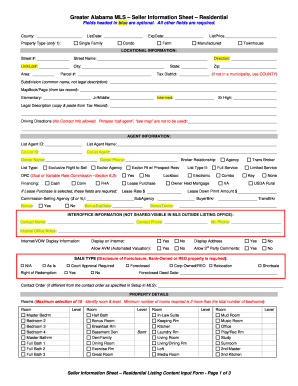

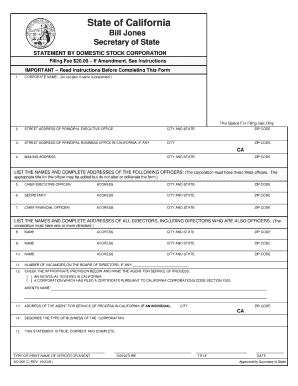

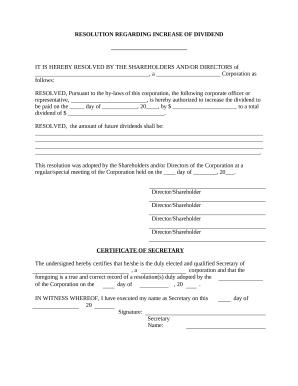

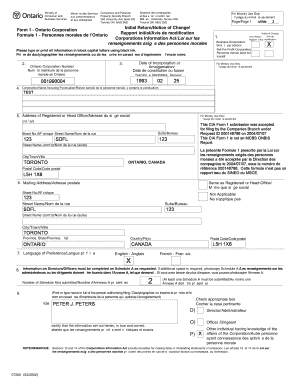

Navigate our comprehensive catalog of Capital dividend resolution Canada Forms and locate the form you require. Complete and manage your forms easily with DocHub.

Accelerate your file administration using our Capital dividend resolution Canada Forms category with ready-made document templates that meet your needs. Access the form template, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your forms.

The best way to use our Capital dividend resolution Canada Forms:

Examine all the possibilities for your online document administration with the Capital dividend resolution Canada Forms. Get your totally free DocHub profile right now!