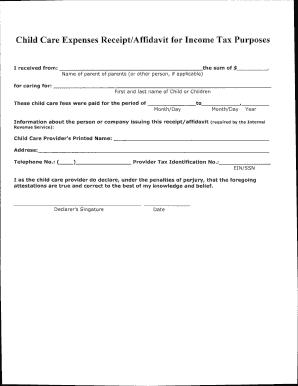

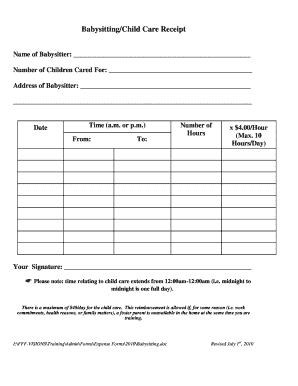

Locate business-specific Babysitting receipt Canada Forms and remain compliant with local and international regulations. Adjust, fill, and securely save your forms without switching between accounts.

Your workflows always benefit when you can discover all the forms and documents you require on hand. DocHub provides a wide array of documents to relieve your daily pains. Get hold of Babysitting receipt Canada Forms category and quickly find your form.

Begin working with Babysitting receipt Canada Forms in several clicks:

Enjoy effortless document administration with DocHub. Check out our Babysitting receipt Canada Forms collection and get your form today!