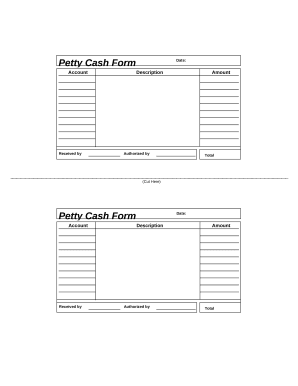

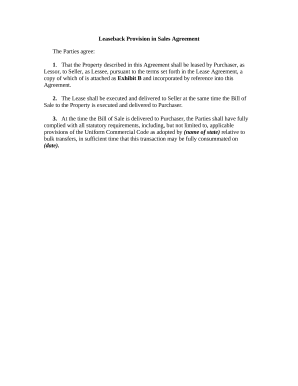

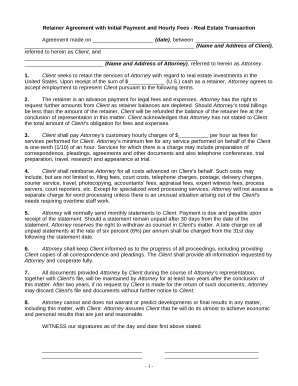

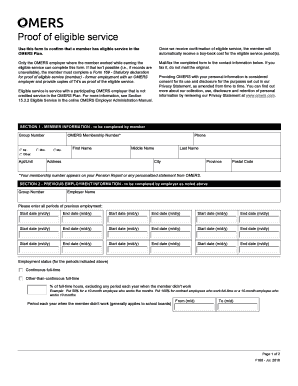

Locate Accounting policies and procedures manual Canada Forms and easily fill them online. Prepare for the upcoming tax season and securely distribute your documents online without compromising your information integrity.

Accelerate your file operations with the Accounting policies and procedures manual Canada Forms collection with ready-made form templates that meet your requirements. Get the form, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to manage our Accounting policies and procedures manual Canada Forms:

Examine all the opportunities for your online document management with the Accounting policies and procedures manual Canada Forms. Get a totally free DocHub profile right now!