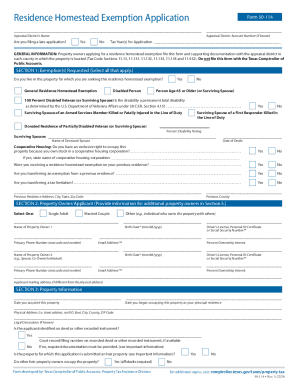

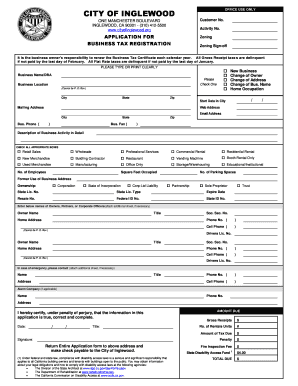

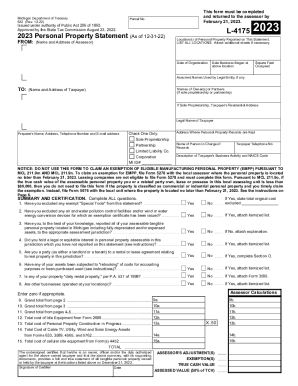

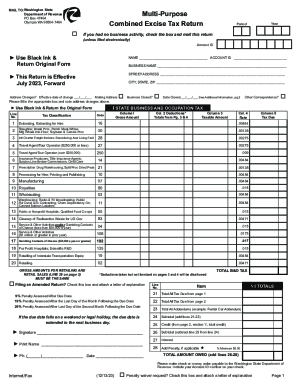

Remain compliant with state-specific Home tax Business Forms. Ensure that your business workflows are accurate and secure, and adhere with local and international laws.

Document administration consumes to half of your business hours. With DocHub, you can easily reclaim your time and improve your team's efficiency. Access Home tax Business Forms collection and discover all templates related to your everyday workflows.

Easily use Home tax Business Forms:

Speed up your everyday file administration with the Home tax Business Forms. Get your free DocHub profile today to explore all templates.