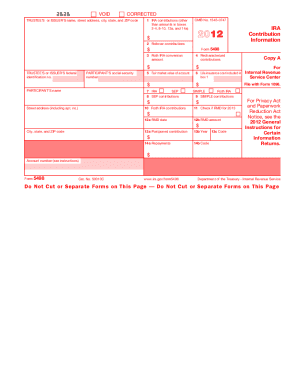

Get started with a comprehensive collection of Adams 1099 Business Forms. Choose, edit, complete, and distribute your business templates without a hassle.

Improve your form administration with our Adams 1099 Business Forms collection with ready-made templates that meet your needs. Access your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

The best way to manage our Adams 1099 Business Forms:

Examine all of the possibilities for your online file administration with our Adams 1099 Business Forms. Get your free free DocHub account today!