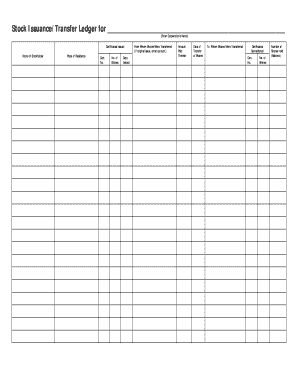

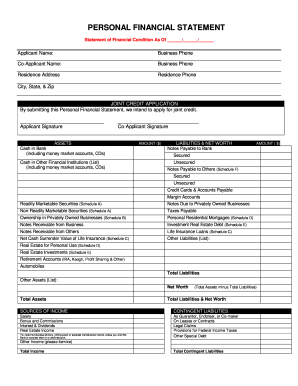

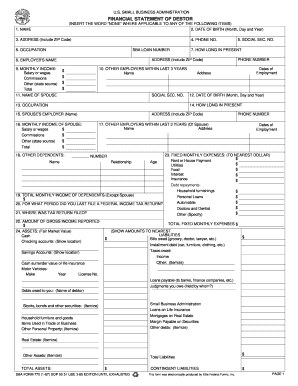

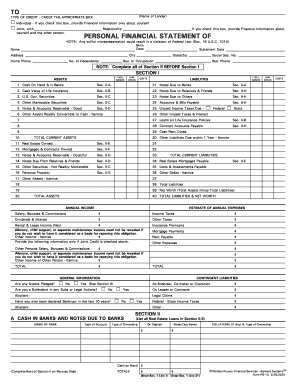

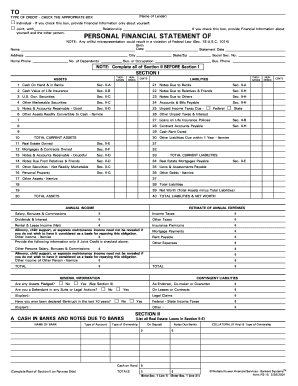

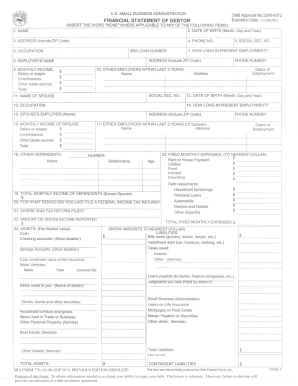

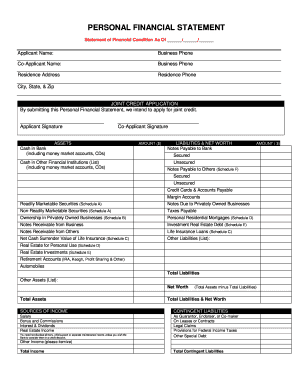

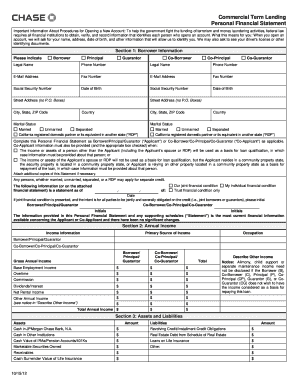

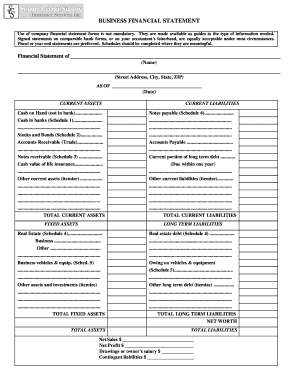

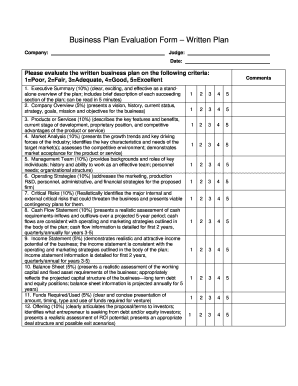

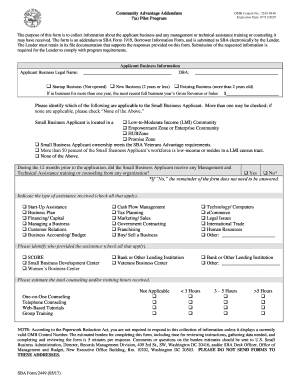

Obtain ready-made Sba Balance Sheet Templates and easily customize them online. With DocHub, you can obtain relevant insights into your financial state and make data-driven choices.

Record management consumes to half of your office hours. With DocHub, you can reclaim your time and boost your team's efficiency. Access Sba Balance Sheet Templates collection and investigate all templates related to your everyday workflows.

The best way to use Sba Balance Sheet Templates:

Boost your everyday file management with our Sba Balance Sheet Templates. Get your free DocHub profile right now to discover all forms.