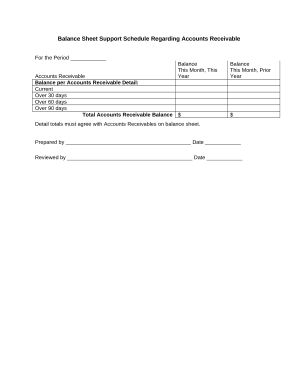

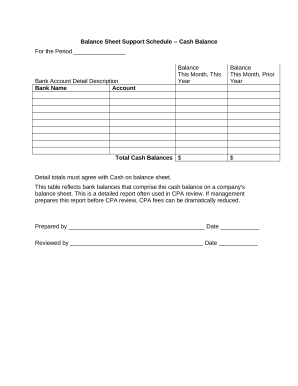

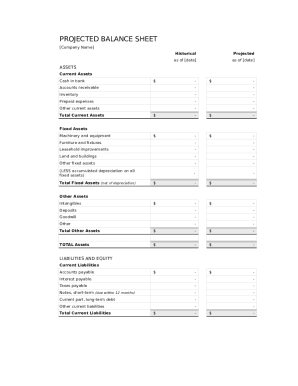

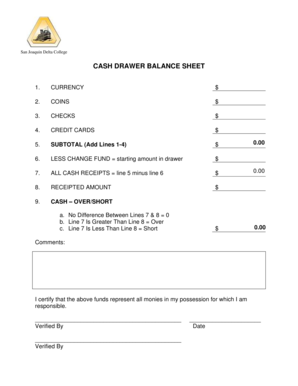

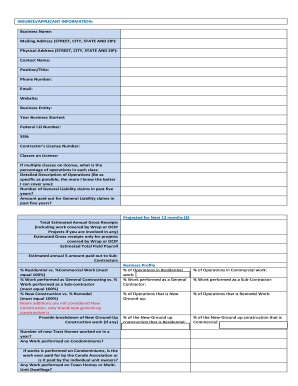

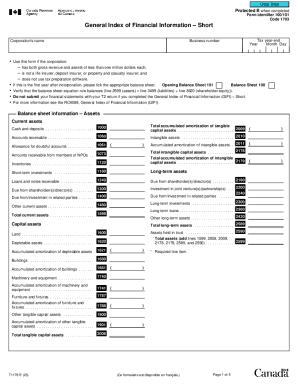

Choose General Balance Sheet Templates to ensure your financial processes' transparency and accuracy. Effortlessly fill out and securely share your records with your team and other contributors.

Record administration occupies to half of your business hours. With DocHub, it is easy to reclaim your office time and increase your team's efficiency. Access General Balance Sheet Templates category and discover all form templates relevant to your day-to-day workflows.

Effortlessly use General Balance Sheet Templates:

Improve your day-to-day file administration with our General Balance Sheet Templates. Get your free DocHub account today to explore all forms.