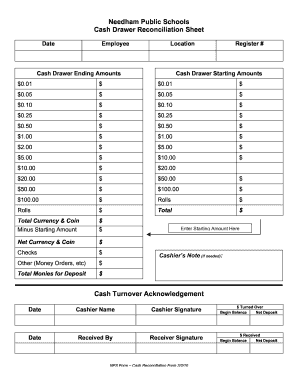

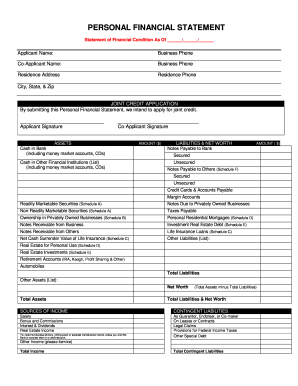

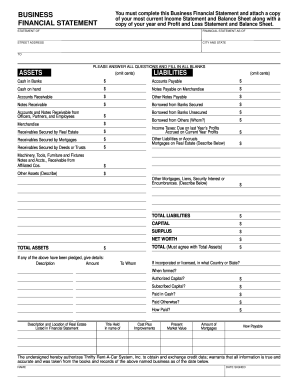

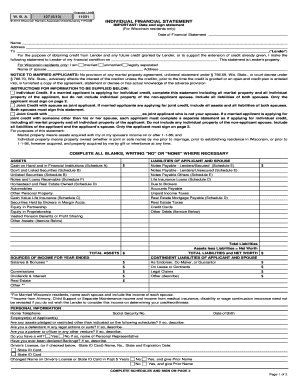

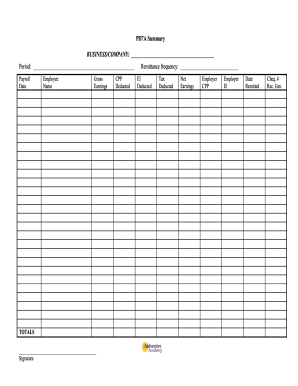

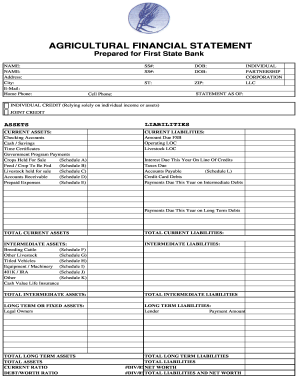

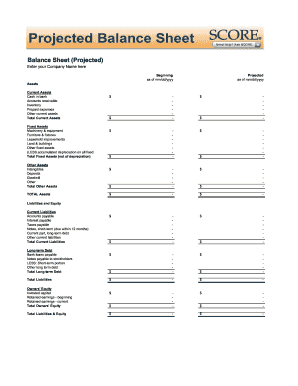

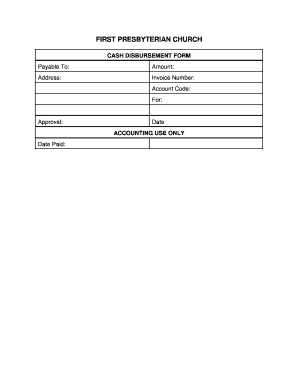

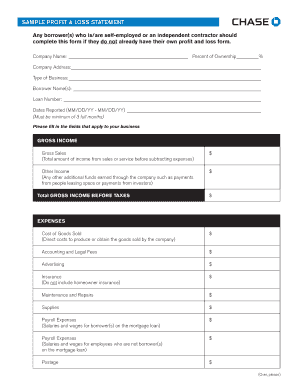

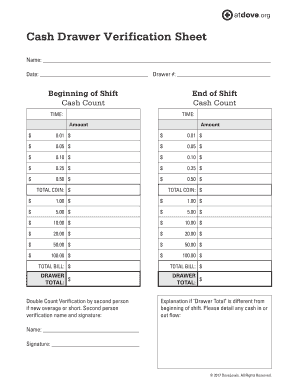

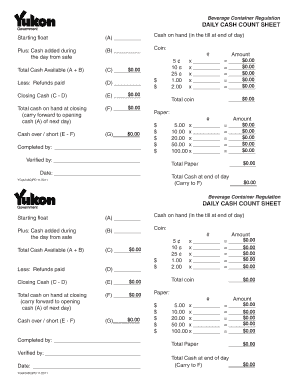

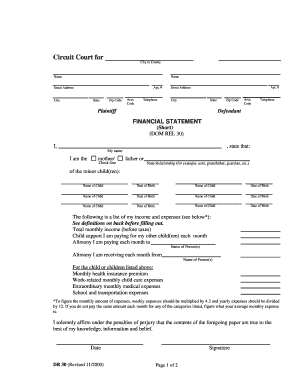

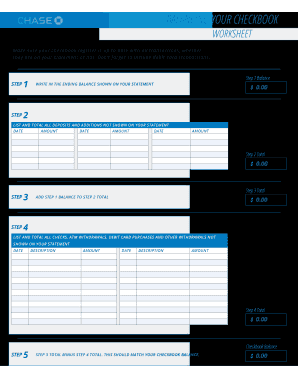

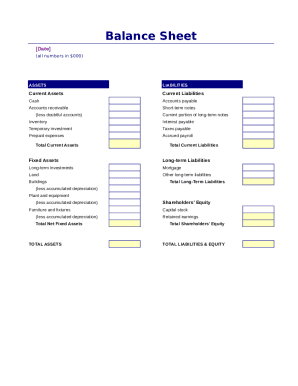

Get ready-made Blank cash register Balance Sheet Templates and effortlessly customize them online. With DocHub, you can gain relevant information into your financial situation and make data-driven choices.

Document managing can overwhelm you when you can’t discover all of the documents you require. Fortunately, with DocHub's considerable form library, you can find all you need and quickly deal with it without the need of changing between apps. Get our Blank cash register Balance Sheet Templates and start utilizing them.

Using our Blank cash register Balance Sheet Templates using these simple steps:

Try out DocHub and browse our Blank cash register Balance Sheet Templates category without trouble. Get a free profile right now!