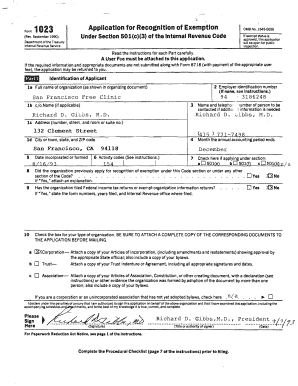

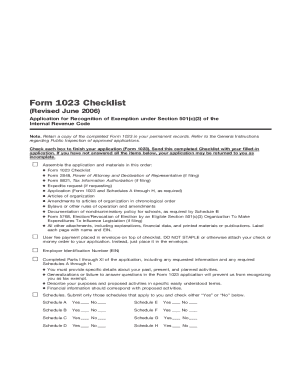

Browse various Tax exempt status 1023 Application Forms relevant to your requirements. Streamline the document submission process and safely keep finished forms within your DocHub account.

Speed up your file operations using our Tax exempt status 1023 Application Forms online library with ready-made templates that suit your needs. Access the document template, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively together with your forms.

The best way to manage our Tax exempt status 1023 Application Forms:

Discover all of the opportunities for your online file administration with our Tax exempt status 1023 Application Forms. Get your free free DocHub account right now!