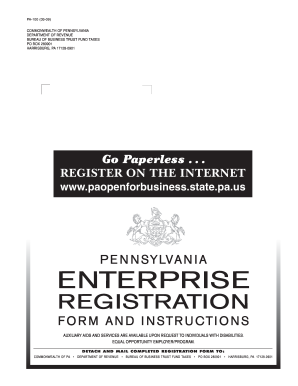

Explore numerous of customizable and free Pa business license Application Forms with DocHub. Edit, fill, and invite other contributors to work together on your application forms in real-time.

Form administration takes up to half of your business hours. With DocHub, it is easy to reclaim your office time and enhance your team's productivity. Get Pa business license Application Forms category and check out all templates related to your everyday workflows.

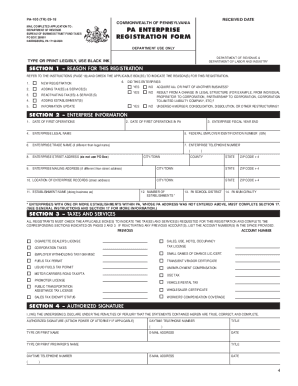

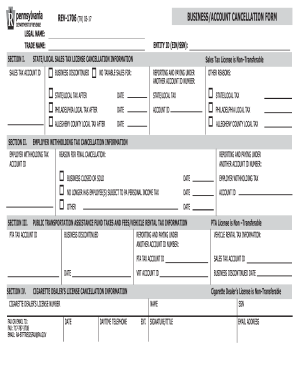

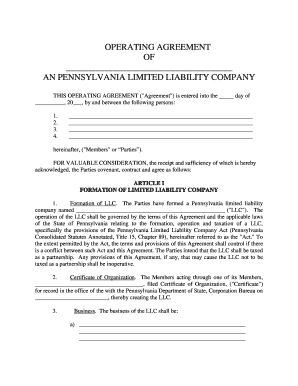

Effortlessly use Pa business license Application Forms:

Accelerate your everyday document administration using our Pa business license Application Forms. Get your free DocHub account today to explore all forms.