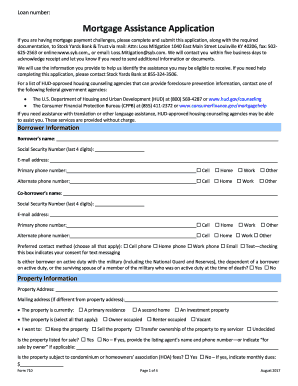

View and choose New mortgage Application Forms documents and safely distribute them. Modify, fill out, and store your templates without breaking a sweat with DocHub free account.

Your workflows always benefit when you can easily find all the forms and documents you may need on hand. DocHub delivers a a large collection forms to ease your everyday pains. Get a hold of New mortgage Application Forms category and quickly find your form.

Start working with New mortgage Application Forms in several clicks:

Enjoy smooth document managing with DocHub. Discover our New mortgage Application Forms collection and discover your form right now!