Enhance your customer experience with Llc texas Application Forms. get, adjust, and provide forms for other contributors to complete in just a few clicks.

Document management consumes to half of your office hours. With DocHub, it is simple to reclaim your office time and improve your team's productivity. Get Llc texas Application Forms online library and explore all form templates related to your day-to-day workflows.

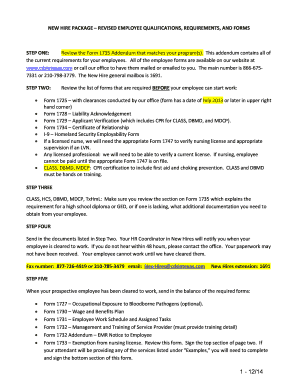

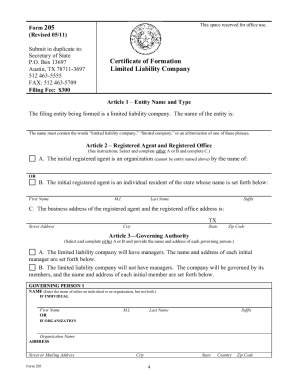

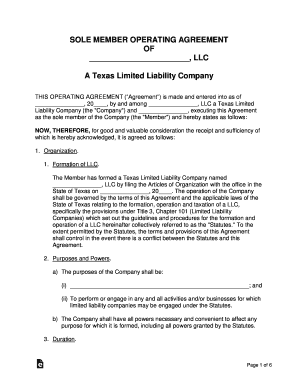

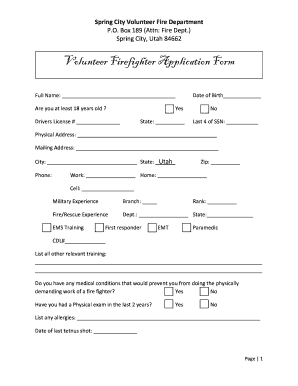

Easily use Llc texas Application Forms:

Speed up your day-to-day document management using our Llc texas Application Forms. Get your free DocHub account today to explore all forms.