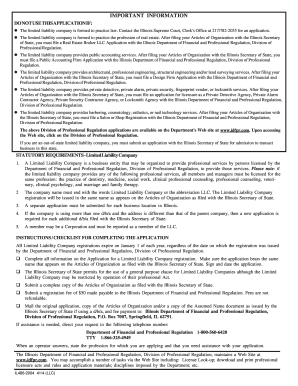

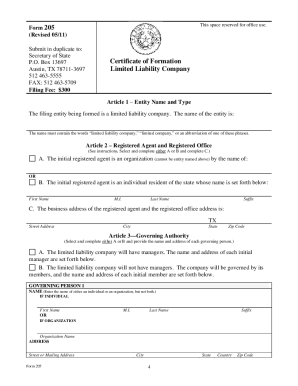

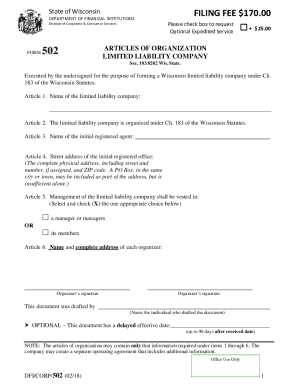

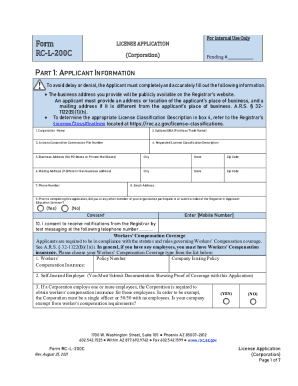

Navigate and edit Llc Application Forms templates with a free DocHub account. Fill out, share, or print your documents and accelerate application submission process without holdups.

Accelerate your file administration with the Llc Application Forms library with ready-made templates that meet your needs. Get your document template, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the documents.

The best way to use our Llc Application Forms:

Discover all of the possibilities for your online file administration using our Llc Application Forms. Get your totally free DocHub profile today!