Monitor and maximize your Debt relief Application Forms handling. Effortlessly find, preview, and fill out documents for personal and business use with DocHub free profile.

Form management consumes to half of your business hours. With DocHub, it is easy to reclaim your office time and boost your team's productivity. Access Debt relief Application Forms collection and investigate all form templates related to your day-to-day workflows.

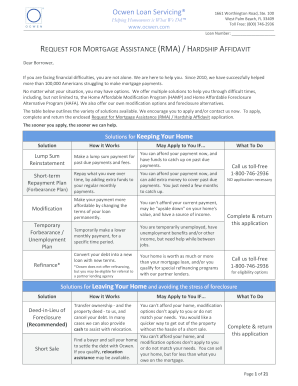

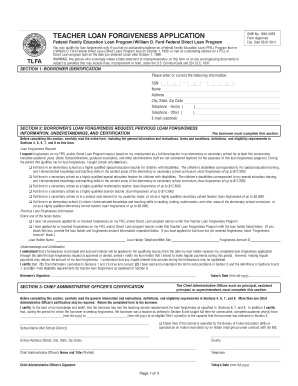

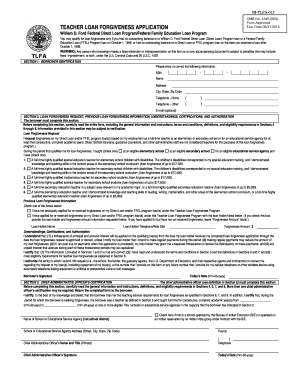

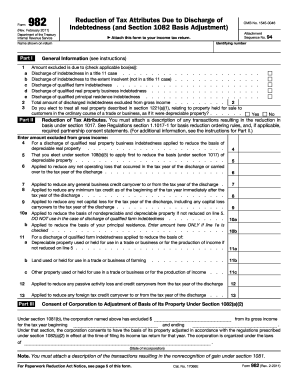

Effortlessly use Debt relief Application Forms:

Boost your day-to-day file management using our Debt relief Application Forms. Get your free DocHub account today to explore all templates.