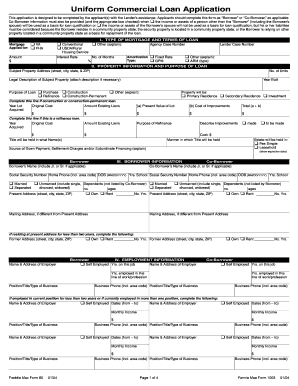

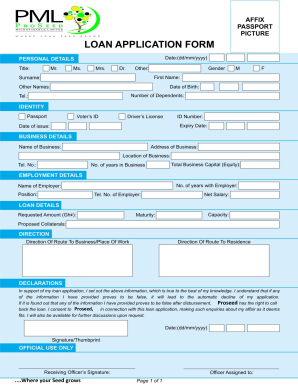

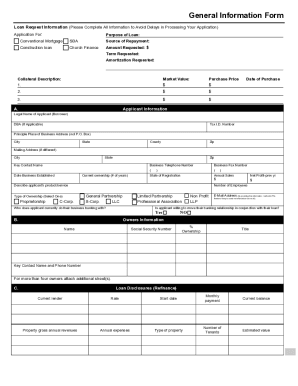

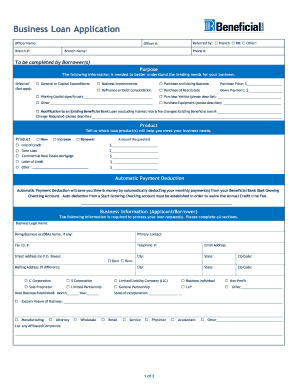

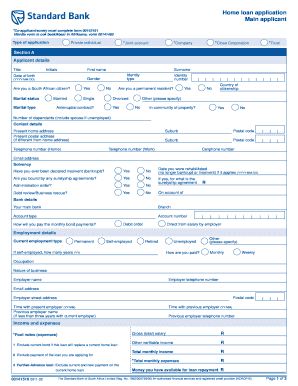

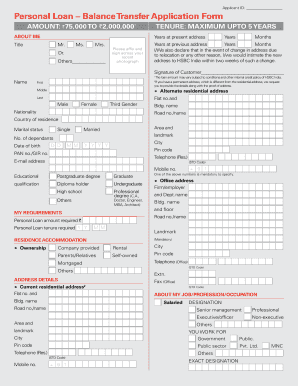

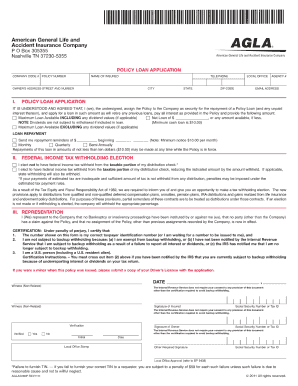

Browse dozens of customizable and no-cost Business loan Application Forms with DocHub. Adjust, fill out, and invite other contributors to work together on your application forms in real-time.

Form managing consumes to half of your office hours. With DocHub, you can reclaim your office time and improve your team's productivity. Get Business loan Application Forms collection and check out all templates related to your everyday workflows.

The best way to use Business loan Application Forms:

Accelerate your everyday file managing with the Business loan Application Forms. Get your free DocHub account today to discover all templates.