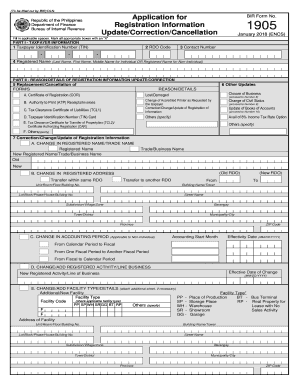

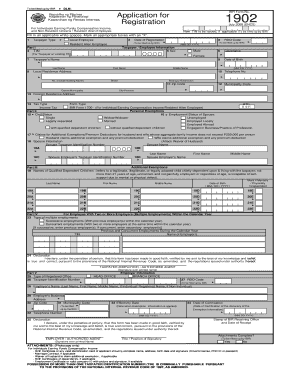

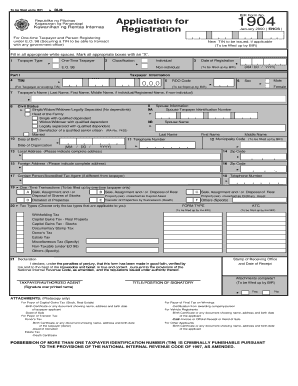

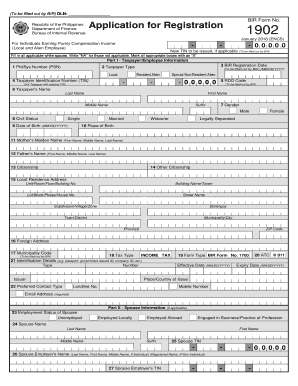

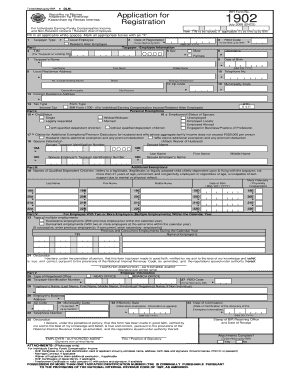

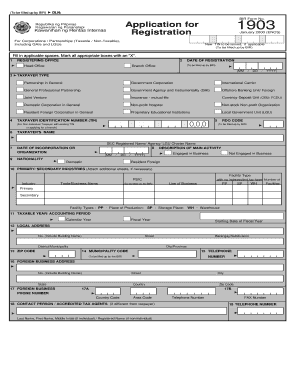

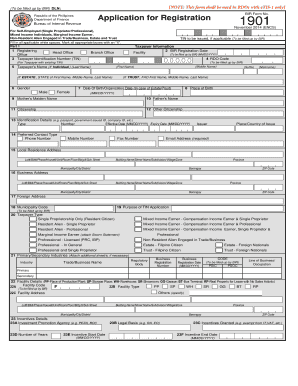

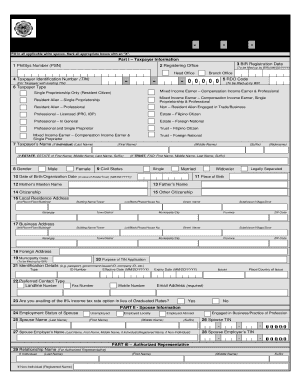

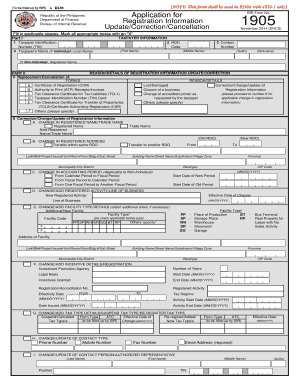

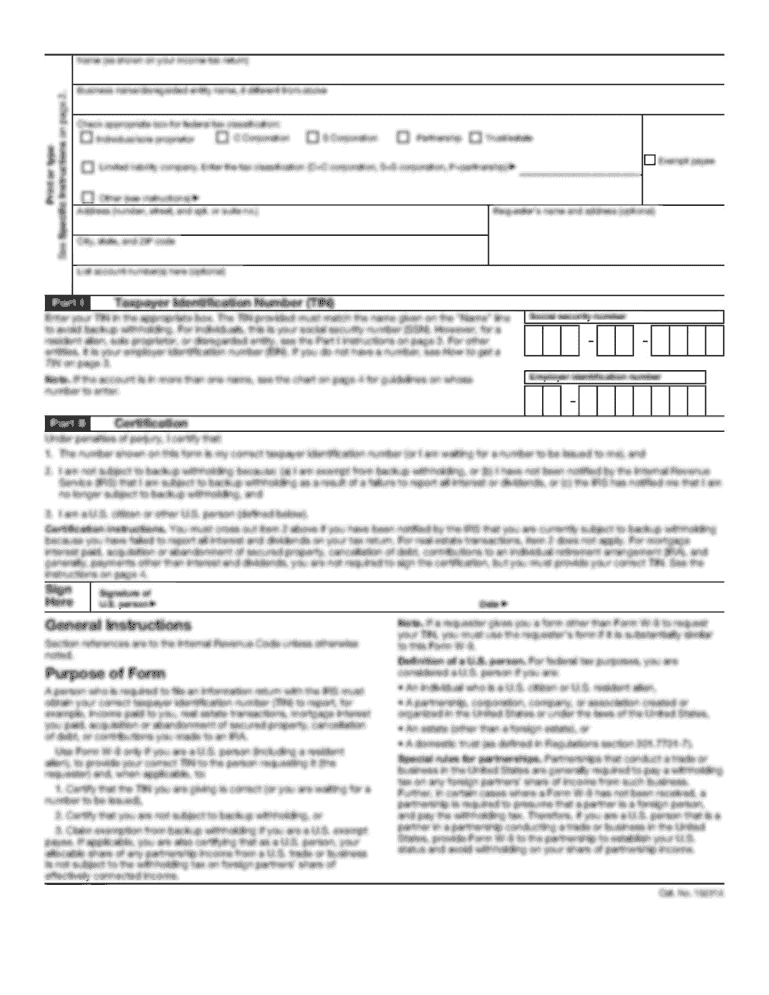

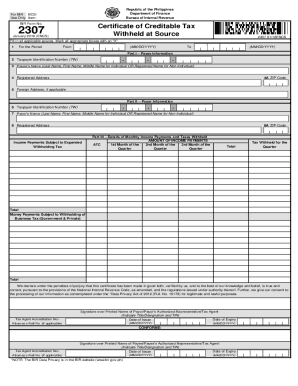

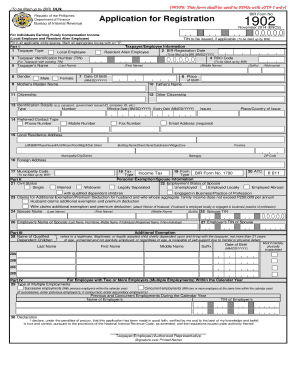

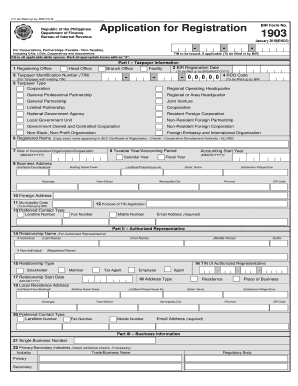

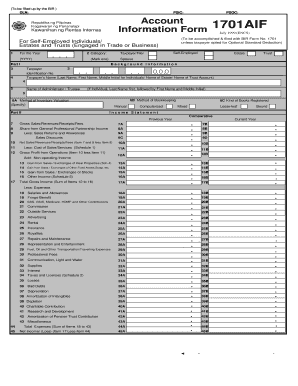

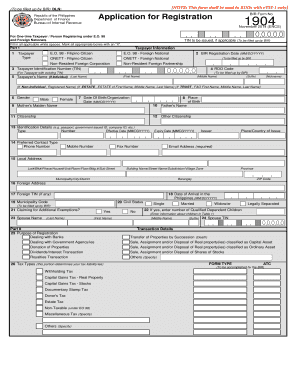

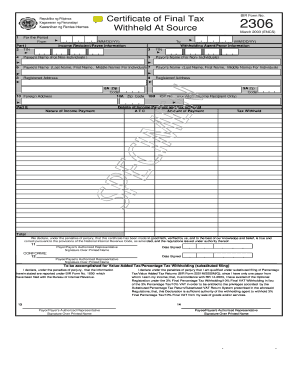

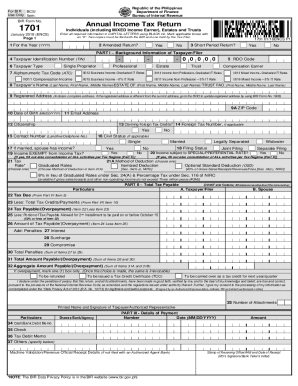

Simplify your document submission workflow with Bir tin Application Forms. Personalize and send ready-to-use documents without logging off from your DocHub profile.

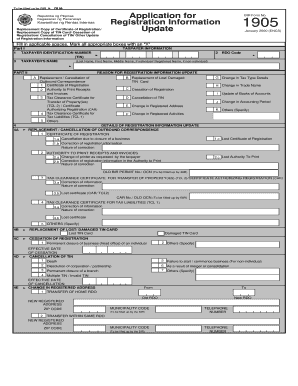

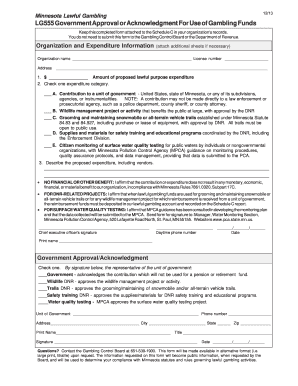

Your workflows always benefit when you can easily locate all of the forms and files you may need at your fingertips. DocHub provides a a huge collection of forms to ease your everyday pains. Get hold of Bir tin Application Forms category and quickly find your document.

Begin working with Bir tin Application Forms in a few clicks:

Enjoy seamless file administration with DocHub. Discover our Bir tin Application Forms category and get your form right now!