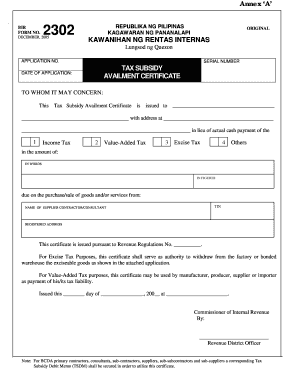

See and choose Bir 2303 Application Forms templates and securely distribute them. Modify, fill out, and store your templates without breaking a sweat with DocHub free profile.

Record managing takes up to half of your office hours. With DocHub, it is easy to reclaim your time and enhance your team's efficiency. Get Bir 2303 Application Forms collection and explore all templates relevant to your everyday workflows.

The best way to use Bir 2303 Application Forms:

Boost your everyday file managing with our Bir 2303 Application Forms. Get your free DocHub account today to explore all templates.