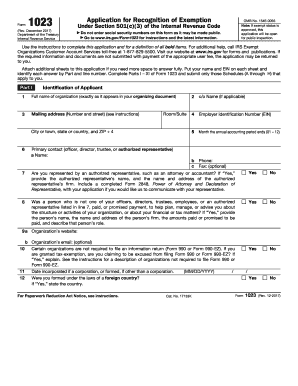

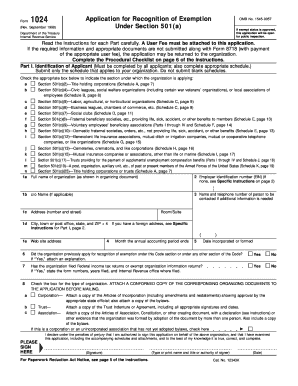

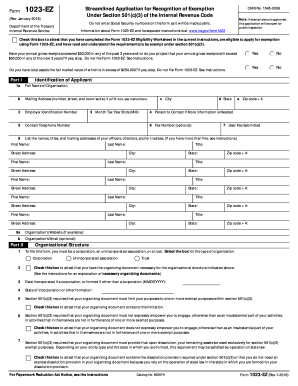

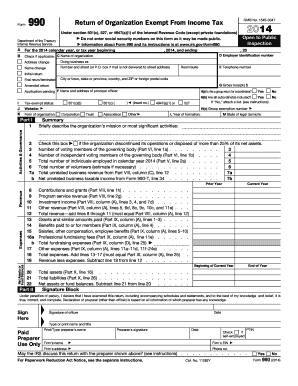

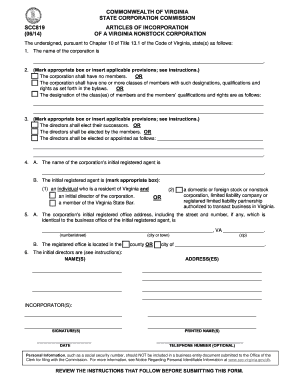

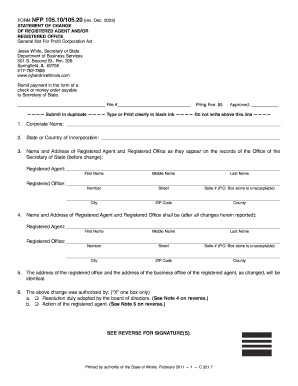

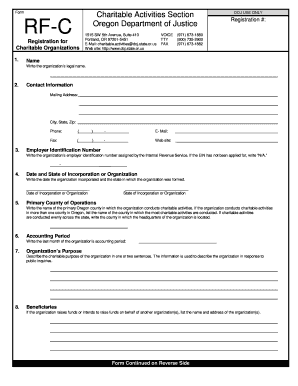

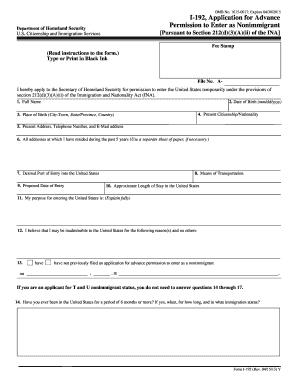

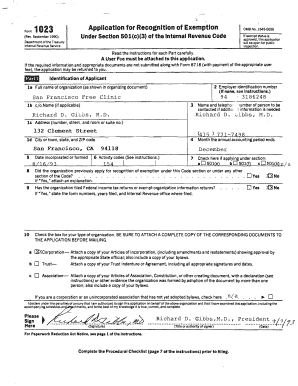

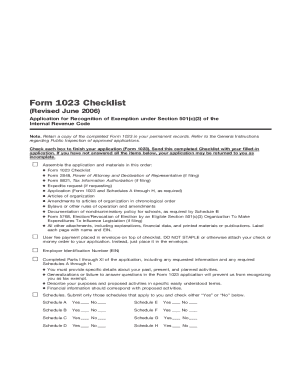

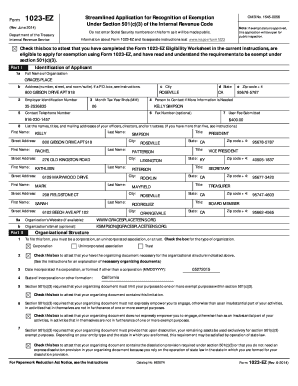

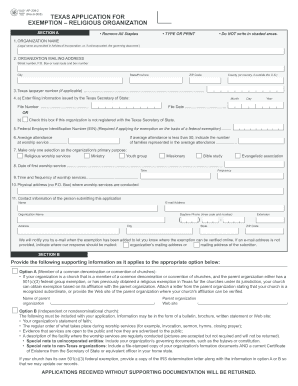

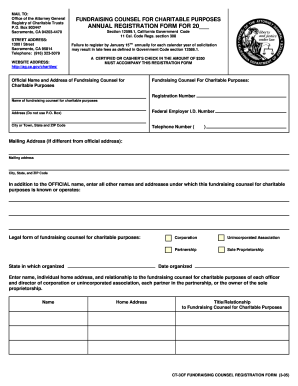

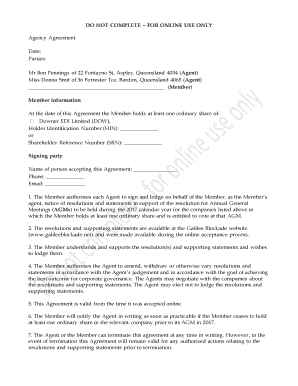

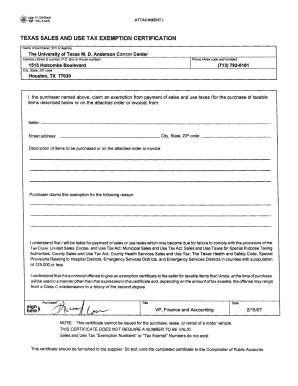

Modify and manage 501c3 1023 Application Forms online for free with DocHub. save, modify, and send application forms, minimizing errors and streamlining the process.

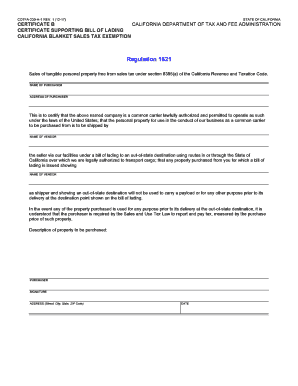

Record administration consumes to half of your office hours. With DocHub, you can reclaim your office time and enhance your team's efficiency. Get 501c3 1023 Application Forms category and discover all document templates relevant to your everyday workflows.

Easily use 501c3 1023 Application Forms:

Accelerate your everyday file administration with the 501c3 1023 Application Forms. Get your free DocHub account today to explore all templates.