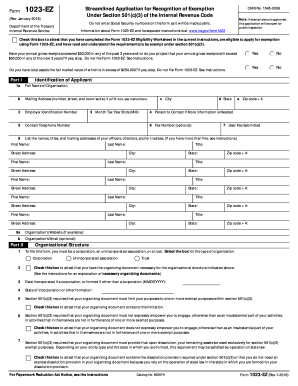

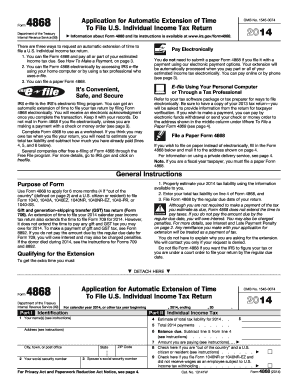

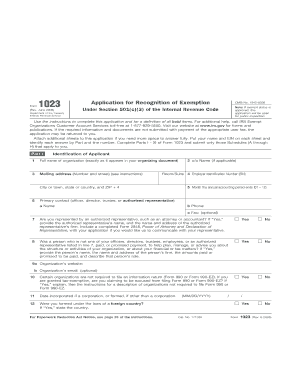

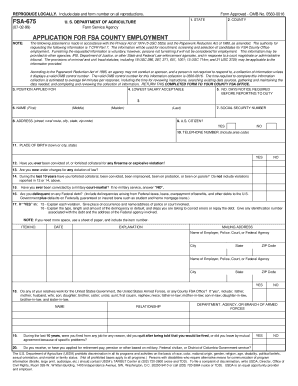

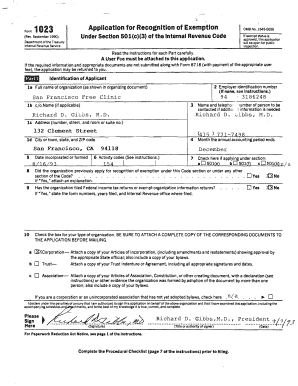

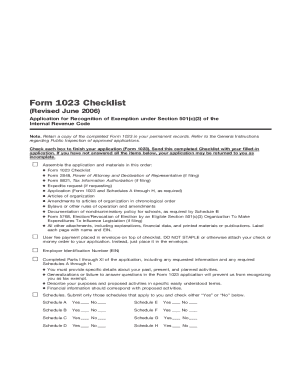

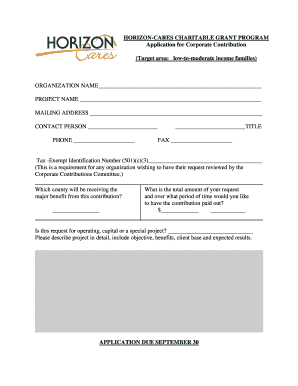

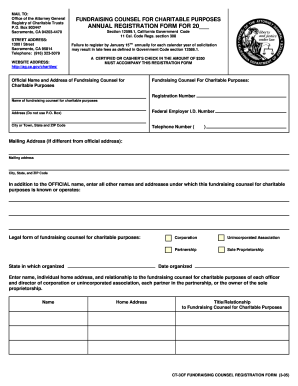

Simplify your application submission workflow with 501c Application Forms. Personalize and distribute ready-to-use templates without switching from your DocHub profile.

Accelerate your document operations with our 501c Application Forms category with ready-made templates that meet your needs. Get your document, modify it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with the forms.

How to use our 501c Application Forms:

Explore all of the possibilities for your online file management with the 501c Application Forms. Get a totally free DocHub profile today!