|

|

TaxAct | |

|---|---|---|

| library of ALL tax forms | ||

| tax filing | ||

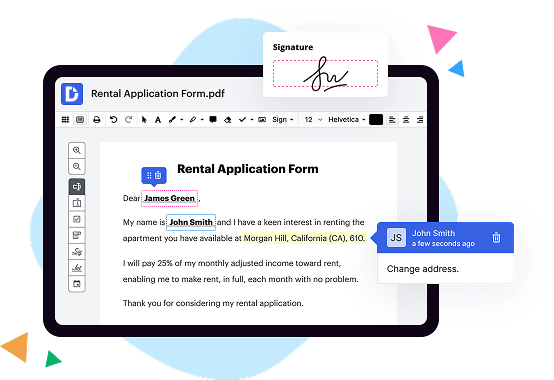

| PDF editor | ||

| tax calendar | ||

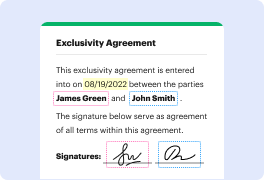

| e-signature tool | ||

| reviewing forms before filing | ||

| printing forms | ||

| downloading forms | ||

| online fax | ||

| cloud storage integrations | ||

| Get DocHub for free |

You may right click on the document and click on Save as to save it to the location you wish. Your Return file will be saved with the extension of . pdf and can be viewed at a later time by opening it in docHub Reader.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.