|

|

TurboTax | |

|---|---|---|

| library of ALL tax forms | ||

| taxes' filing | ||

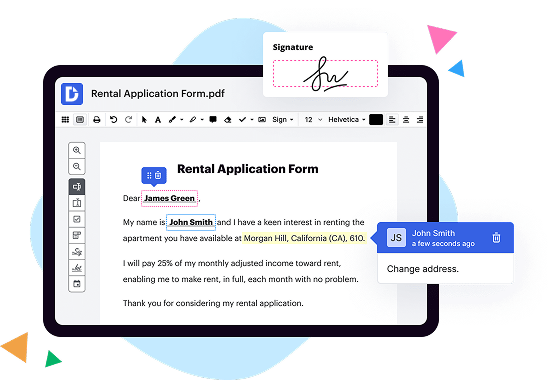

| PDF editor | ||

| tax calendar | ||

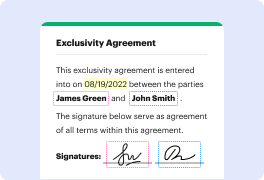

| e-signature tool | ||

| reviewing forms before filing | ||

| printing forms | ||

| downloading forms | ||

| online fax | ||

| cloud storage integrations | ||

| Get DocHub for free |

Open or continue your return. Select File in the menu and then select Start next to Step 1 Review your order. Select View payment options. Select Pay now(or Pay with Federal Refund, if that option is available) to make your payment.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.