|

|

TaxAct | |

|---|---|---|

| library of ALL tax forms | ||

| tax filing | ||

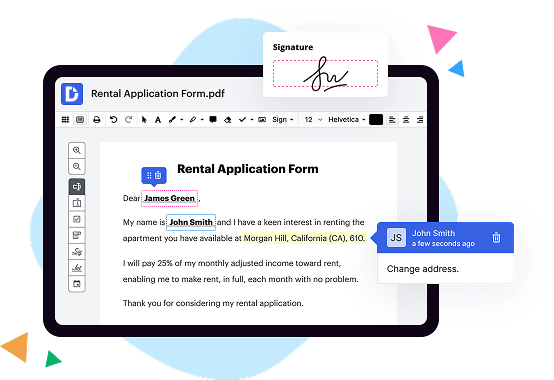

| PDF editor | ||

| tax calendar | ||

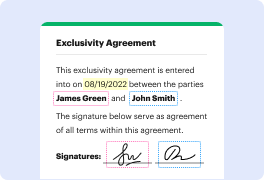

| e-signature tool | ||

| reviewing forms before filing | ||

| printing forms | ||

| downloading forms | ||

| online fax | ||

| cloud storage integrations | ||

| Get DocHub for free |

Sign in to your TaxAct Online return. Click the My Return button in the top right corner. Click Print Center, then click the Custom tab. Scroll down in the bottom section (the bottom section lists documents received or worksheets) and click on the checkbox(es) to the left of the item(s) click Federal Form 8949

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.