|

|

Signmee | |

|---|---|---|

| No Downloads | ||

| CRMs, Google Docs, Office 365 | ||

| Search Form Online | ||

| New Form and Document Creator | ||

| Host Fillable Forms | ||

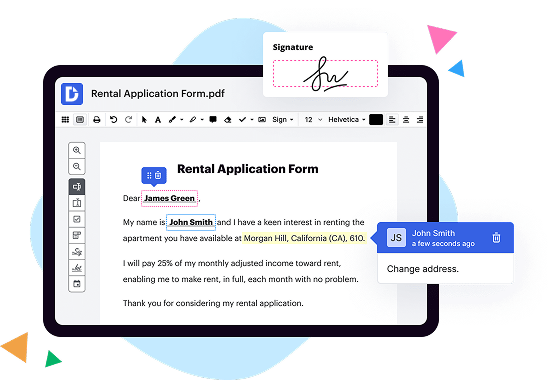

| Edit PDF | ||

| Fill Online | ||

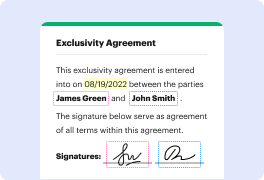

| Sign Online | ||

| PDF converter | ||

| Annotate PDF | ||

| Search text in PDF | ||

| Collaborate and Versions | ||

| Encryption and Security | ||

| Two-Factor Authentication | ||

| Unlimited Cloud Storage | ||

| Fax Online | ||

| Track Sending Documents | ||

| API | ||

| Get DocHub for free |

The IRS has implied that Section 6061 and Section 6065 require wet signatures on all documents unless otherwise indicated, pursuant to Rev.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.