|

|

ezTaxReturn | |

|---|---|---|

| library of ALL tax forms | ||

| tax filing | ||

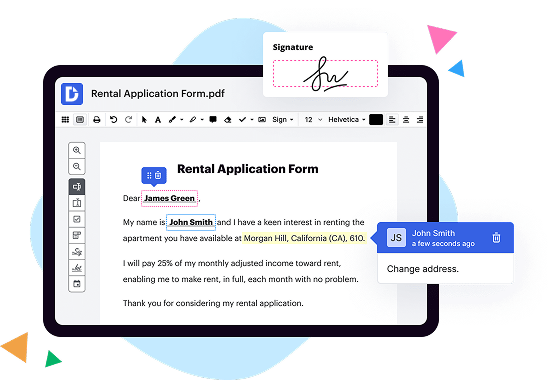

| PDF editor | ||

| tax calendar | ||

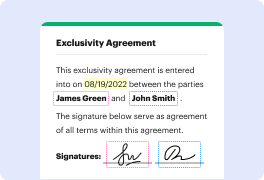

| e-signature tool | ||

| reviewing forms before filing | ||

| printing forms | ||

| downloading forms | ||

| online fax | ||

| cloud storage integrations | ||

| Get DocHub for free |

If you receive a refund to which youre not entitled, or for an amount thats more than you expected, dont cash the check. For a direct deposit that was greater than expected, immediately contact the IRS at 800-829-1040 and your bank or financial institution.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.