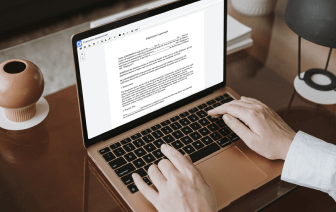

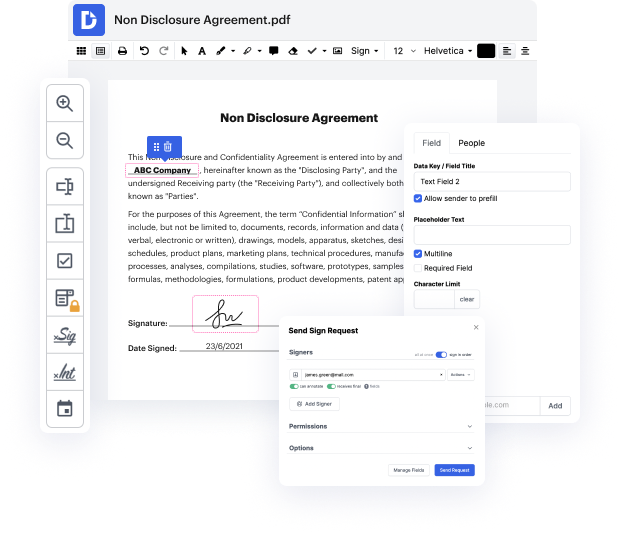

Need to quickly work in company in Subordination Agreement? We've got you covered! With DocHub, you can do just what you need without downloading and installing any software program. Use our solution on your mobile phone, desktop computer, or web browser to modify Subordination Agreement anytime and anywhere. Our feature-rich platform provides basic and advanced editing, annotating, and security features suitable for individuals and small companies. Additionally, we offer detailed tutorials and instructions that help you master its features rapidly. Here's one of them!

We offer a range of security options to protect your sensitive data while you work in company in Subordination Agreement, so you can feel confident of your work’s privacy. Get your documents edited, signed, and delivered with a professional, industry-compliant platform. Take advantage of the comfort of getting the job done instantly with DocHub!

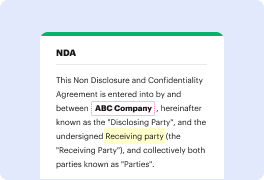

Subordination is when the claim of one creditor to a real estate asset is subordinated, or made junior to the claim of another. This is pretty common, especially in the case of refinancing debt. So lets talk about it and Ill show you how it works. Imagine this is your timeline. And here we have years, zero or the day of acquisition. And on this date, we have senior debt placed on the property. And as we know, claims to any real estate are prioritized in chronological order as to when they were made against the property or recorded on the title. So when we have senior debt on a property, If we go ahead and a little while later, we add some junior, junior debt is subordinate to the senior debt in that its claim on the title was made after the senior debt. But then what happens if the senior debt refinances and a new loan is placed on after the junior debt? So imagine that this debt goes away and now we have this debt. Well, if this is. The senior debt or the primary loan on the propert