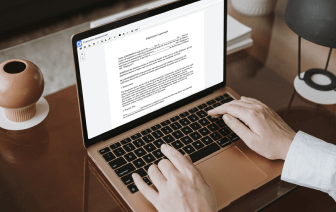

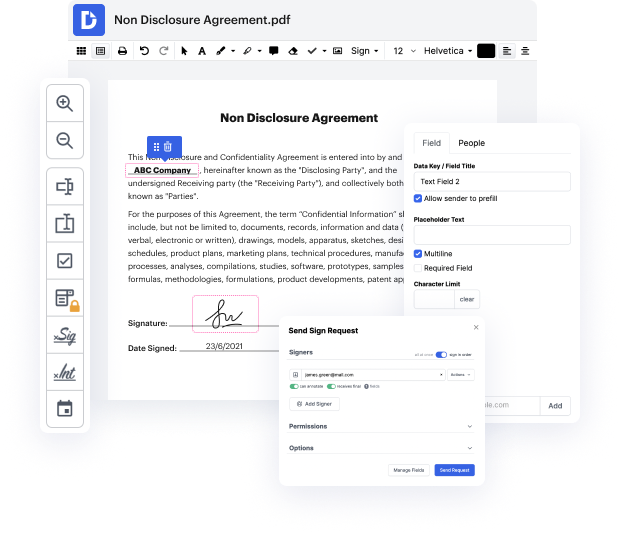

You can’t make document modifications more convenient than editing your ASC files on the web. With DocHub, you can get tools to edit documents in fillable PDF, ASC, or other formats: highlight, blackout, or erase document fragments. Include textual content and images where you need them, rewrite your copy entirely, and more. You can download your edited file to your device or share it by email or direct link. You can also turn your documents into fillable forms and invite others to complete them. DocHub even offers an eSignature that allows you to certify and deliver paperwork for signing with just a couple of clicks.

Your records are securely kept in our DocHub cloud, so you can access them at any time from your PC, laptop, mobile, or tablet. Should you prefer to use your mobile phone for file editing, you can easily do so with DocHub’s app for iOS or Android.

this is a step-by-step example of how to prepare a basic asc 740 tax provision before getting into the details iamp;#39;m showing you on screen the background and assumptions for the sample company in this example now iamp;#39;m not going to go over these items in detail but you may find it helpful to pause the video and read through them before we go any further now that you understand this companyamp;#39;s profile the situation is this year one is ended and itamp;#39;s early to mid january of year two and youamp;#39;ve been tasked with preparing the companyamp;#39;s tax provision you canamp;#39;t do any meaningful work on the tax provision until you have information on the companyamp;#39;s income expenses assets and liabilities so with this in mind your first step is to obtain the latest trial balance of the company from the accounting group now if the final trial balance isnamp;#39;t quite ready thatamp;#39;s okay take whatever the accounting group can give you rig