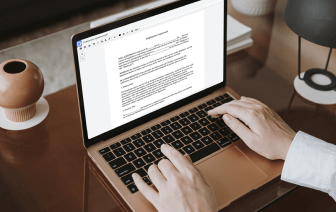

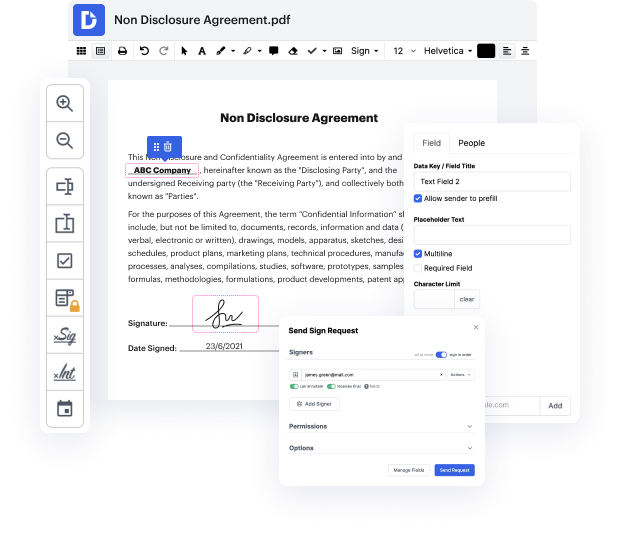

DocHub provides all it takes to easily change, generate and manage and safely store your Form W2 and any other papers online within a single tool. With DocHub, you can stay away from document management's time-wasting and effort-intensive transactions. By eliminating the need for printing and scanning, our ecologically-friendly tool saves you time and decreases your paper usage.

Once you’ve a DocHub account, you can start editing and sharing your Form W2 in mere minutes without any prior experience required. Unlock a number of advanced editing tools to wipe date in Form W2. Store your edited Form W2 to your account in the cloud, or send it to clients using email, dirrect link, or fax. DocHub enables you to convert your document to popular document types without switching between programs.

You can now wipe date in Form W2 in your DocHub account anytime and anywhere. Your documents are all saved in one place, where you’ll be able to change and handle them quickly and effortlessly online. Try it now!

foreign [Music] lets talk about the W-2 form from the IRS which is a pretty important document when it comes to filing your taxes this is a form that employers are required to fill out and send to both you and the IRS annually and it provides information about your earnings for that previous year as well as any taxes withheld the W-2 provides details on what money was earned in that previous year plus it details any withheld taxes paid during that same time frame if you have ever worked for an employer chances are that you received a W-2 tax form at the end of the year employer must send this form to you no later than January 31st following your last year of work in order that you have enough time to file your taxes for that calendar year so what exactly is the W-2 IRS tax form and why is it essential a W-2 form is a document that summarizes your earnings and tax withholdings for the year this form has identifying information such as your name address and social security number it als