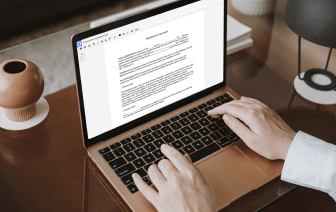

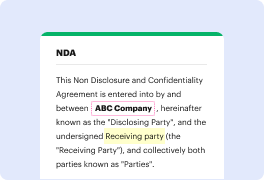

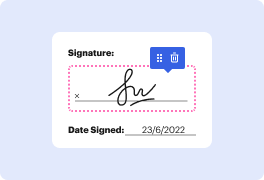

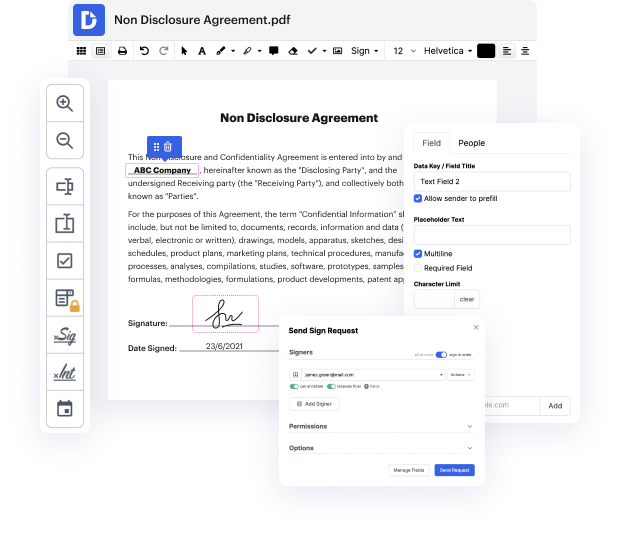

Working with paperwork like Bridge Loan Agreement may appear challenging, especially if you are working with this type the very first time. Sometimes a tiny modification might create a big headache when you do not know how to work with the formatting and avoid making a chaos out of the process. When tasked to void phone in Bridge Loan Agreement, you could always use an image modifying software. Other people may choose a classical text editor but get stuck when asked to re-format. With DocHub, though, handling a Bridge Loan Agreement is not harder than modifying a document in any other format.

Try DocHub for quick and efficient papers editing, regardless of the document format you might have on your hands or the type of document you need to revise. This software solution is online, accessible from any browser with a stable internet access. Edit your Bridge Loan Agreement right when you open it. We have developed the interface to ensure that even users with no prior experience can readily do everything they need. Simplify your paperwork editing with a single streamlined solution for any document type.

Working with different types of papers should not feel like rocket science. To optimize your papers editing time, you need a swift solution like DocHub. Manage more with all our tools at your fingertips.

Jeff Smith from Coldwell Banker Residential Brokerage in California discusses bridge loans in this tutorial. A bridge loan allows you to use the equity from your current home to buy a new property without selling your existing home. This is beneficial in a competitive market where homes sell quickly. Making a contingent offer on a new property while your current home is in escrow can be challenging, so a bridge loan can help you secure the new property. Learning about qualifying for bridge loans is also essential for this process.