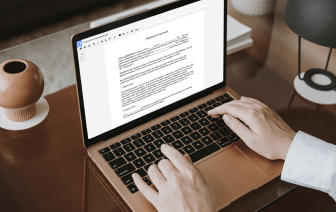

Not all formats, such as tex, are developed to be effortlessly edited. Even though numerous features can help us modify all form formats, no one has yet created an actual all-size-fits-all solution.

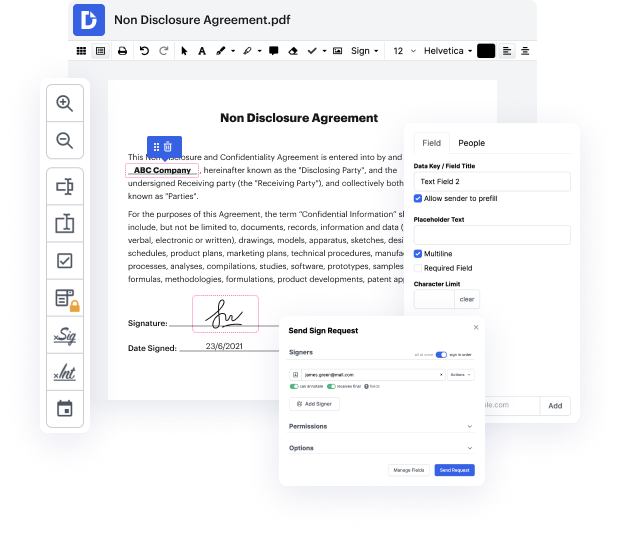

DocHub provides a simple and efficient solution for editing, managing, and storing paperwork in the most widely used formats. You don't have to be a technology-knowledgeable user to take out ssn in tex or make other changes. DocHub is powerful enough to make the process straightforward for everyone.

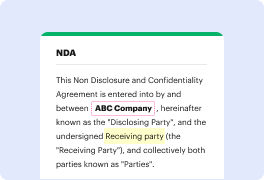

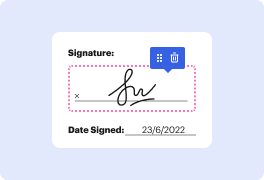

Our feature allows you to alter and tweak paperwork, send data back and forth, create dynamic documents for information collection, encrypt and safeguard documents, and set up eSignature workflows. In addition, you can also generate templates from paperwork you use on a regular basis.

You’ll find a great deal of other functionality inside DocHub, such as integrations that allow you to link your tex form to various productivity apps.

DocHub is a simple, fairly priced way to manage paperwork and streamline workflows. It provides a wide range of capabilities, from generation to editing, eSignature services, and web document developing. The program can export your files in multiple formats while maintaining maximum security and adhering to the highest information safety standards.

Give DocHub a go and see just how straightforward your editing process can be.

thank you hello text Park Family my name is Chanel Parks I am the owner and founder of tech spark financial and Business Solutions so todayamp;#39;s video is going to be about getting your IPP in okay so itamp;#39;s your identity protection pin number which is a six digit number okay so what weamp;#39;re going to be discussing today is how do you protect your own identity and how do you take protect your childrenamp;#39;s identity okay so we have a lot of issues where um people will go and file children and they know theyamp;#39;re not supposed to file them and then you will go and do your tax return and then there will be rejections okay so I get this at least five times minimum um per tax season where a mom will come to me those are her children and then she they will get rejected and sheamp;#39;s like I donamp;#39;t know who filed my children well honestly I donamp;#39;t know either and I donamp;#39;t know that youamp;#39;ll ever find out by the IRS Okay so what we