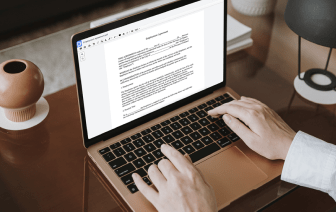

Dealing with paperwork implies making small corrections to them daily. Sometimes, the task runs almost automatically, especially when it is part of your daily routine. However, in other instances, dealing with an unusual document like a Bank Loan Proposal Template can take precious working time just to carry out the research. To make sure that every operation with your paperwork is effortless and quick, you should find an optimal modifying solution for this kind of tasks.

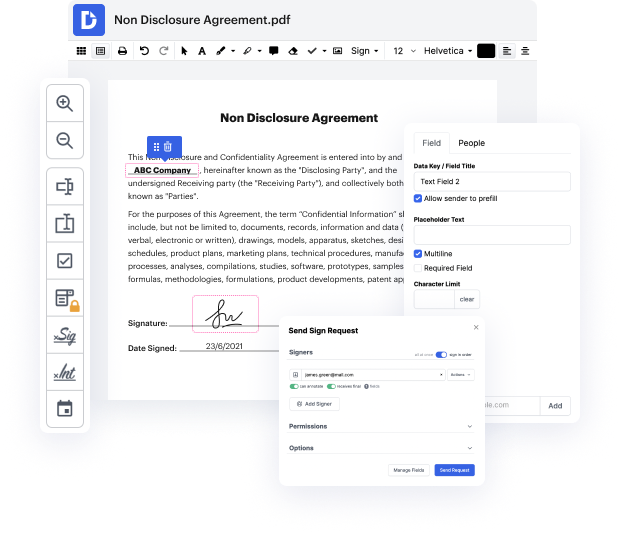

With DocHub, you may learn how it works without spending time to figure everything out. Your tools are laid out before your eyes and are easily accessible. This online solution does not require any sort of background - education or expertise - from its users. It is all set for work even when you are unfamiliar with software typically used to produce Bank Loan Proposal Template. Quickly make, edit, and send out papers, whether you deal with them every day or are opening a new document type the very first time. It takes minutes to find a way to work with Bank Loan Proposal Template.

With DocHub, there is no need to study different document types to figure out how to edit them. Have all the go-to tools for modifying paperwork on hand to improve your document management.

The video tutorial showcases how to set up a personal finance tracker using Notion. The creator shares their workspace and demonstrates setting up databases for monthly income, expenses, and a balance calculator to track finances. The goal is to simplify tracking income and expenses for budgeting purposes. The video provides a step-by-step guide on how to set up this system.