Those who work daily with different documents know very well how much productivity depends on how convenient it is to access editing instruments. When you Hardship Letter documents must be saved in a different format or incorporate complex components, it may be challenging to handle them using classical text editors. A simple error in formatting might ruin the time you dedicated to tack record in Hardship Letter, and such a basic job should not feel challenging.

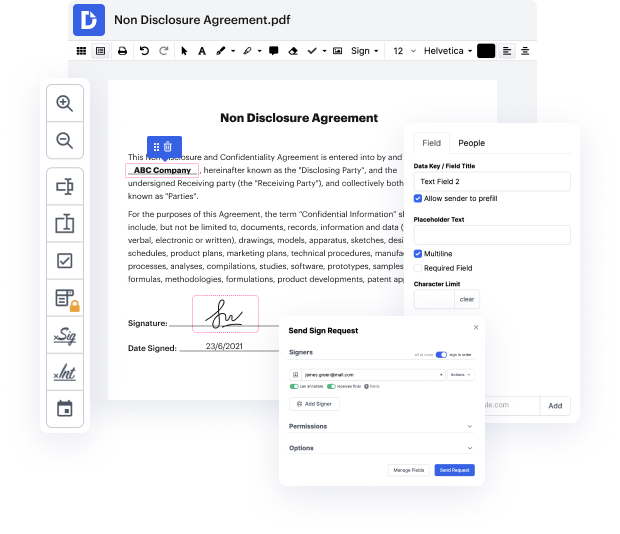

When you discover a multitool like DocHub, this kind of concerns will in no way appear in your projects. This powerful web-based editing platform will help you quickly handle documents saved in Hardship Letter. You can easily create, modify, share and convert your files anywhere you are. All you need to use our interface is a stable internet access and a DocHub profile. You can create an account within minutes. Here is how easy the process can be.

With a well-developed modifying platform, you will spend minimal time finding out how it works. Start being productive as soon as you open our editor with a DocHub profile. We will ensure your go-to editing instruments are always available whenever you need them.

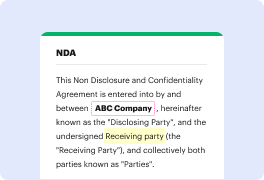

how to write irs hardship letter the irs or the internal revenue service often checks the debt ratio of taxpayers the action will be like this is currently not collectible type and the other one can be the request through a hardship letter to irs this letter is to prove that you are unable to make the payments but you must pay the interest fees and charges you owe the irs the hardship letters are the perfect way to explain your current financial situation with this proof the lenders or the irs may not offer relief from the payment but they will delay the debt collection keep it original the purpose of this letter to the irs is that you are unable to pay the taxes for some financial issues you need to pour the right amount of honesty and integrity that the irs officials would want to see and then consider your appeal avoid blaming others your financial situation may have occurred due to someones irresponsibility or wrongdoing but it will be best if you avoid blaming anyone else keep y