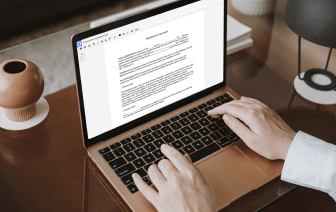

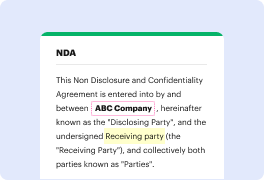

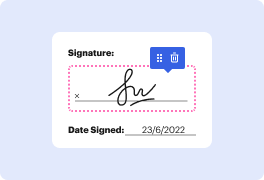

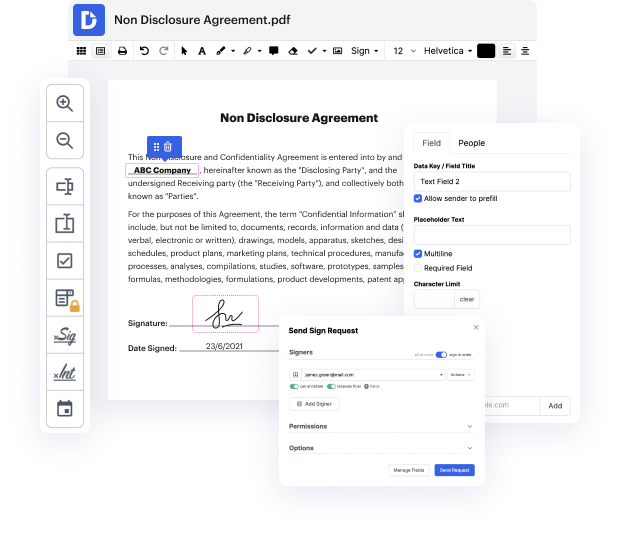

You can’t make document alterations more convenient than editing your DOCM files on the web. With DocHub, you can access tools to edit documents in fillable PDF, DOCM, or other formats: highlight, blackout, or erase document fragments. Include text and images where you need them, rewrite your form completely, and more. You can save your edited file to your device or share it by email or direct link. You can also transform your documents into fillable forms and invite others to complete them. DocHub even provides an eSignature that allows you to certify and send out paperwork for signing with just a few clicks.

Your documents are securely stored in our DocHub cloud, so you can access them anytime from your desktop computer, laptop, mobile, or tablet. If you prefer to use your mobile phone for file editing, you can easily do it with DocHub’s application for iOS or Android.

have you ever been daydreaming and wondered to yourself what the heck is fatca of course you havenamp;#39;t youamp;#39;re probably wondering what the heck iamp;#39;m talking about right now but if youamp;#39;re a us citizen living abroad you should probably ask yourself this question at least once in your life donamp;#39;t panic thatamp;#39;s why weamp;#39;ve created this video series weamp;#39;ll take care of you and your taxes and thatamp;#39;s a fact or should i say factca do you see what i did there sorry tax joke letamp;#39;s talk fatca fatca thatamp;#39;s foreign account tax compliance act this is a federal law that requires foreign financial institutions like banks to report back the data on their u.s account holders it also requires u.s citizens to disclose this information themselves itamp;#39;s used to prevent illegal money laundering abroad yikes this means that if an american opens an account in a foreign bank that bank must comply with fatca laws so you may fin