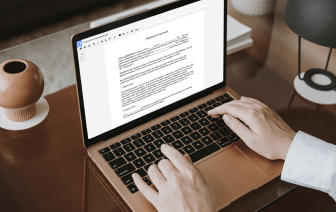

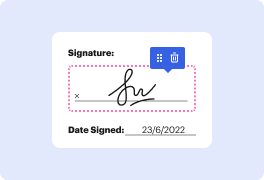

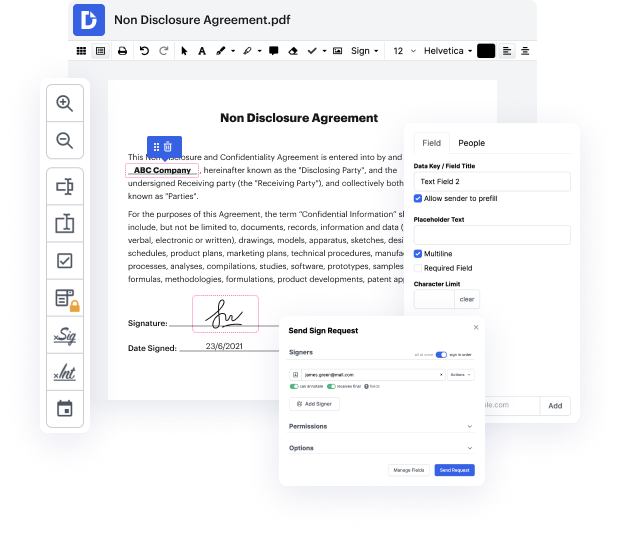

The struggle to handle Independent Contractor Agreement can consume your time and effort and overwhelm you. But no more - DocHub is here to take the effort out of altering and completing your documents. You can forget about spending hours adjusting, signing, and organizing paperwork and stressing about data security. Our platform provides industry-leading data protection procedures, so you don’t need to think twice about trusting us with your sensitive information.

DocHub works with various file formats and is available across multiple platforms.

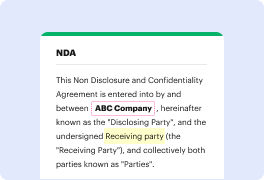

An independent contractor agreement is a contract that allows clients to hire contractors for specific jobs, often referred to as a 1099 agreement due to the IRS form required for tax filing. Unlike employees, independent contractors do not have taxes deducted from their payments and must handle their own tax obligations. This arrangement highlights significant legal differences between independent contractors and employees, offering greater flexibility but less stability. Over the past decade, independent contracting has grown faster than the general workforce, partly due to technological advancements. Employers and workers should consider key factors before creating an independent contractor agreement, including the eligibility of the work.