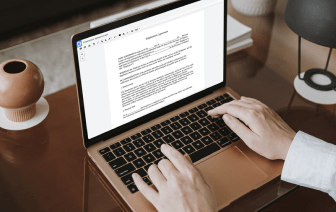

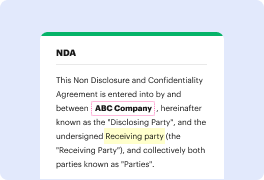

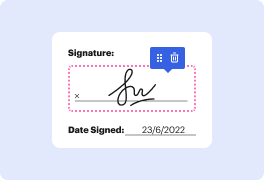

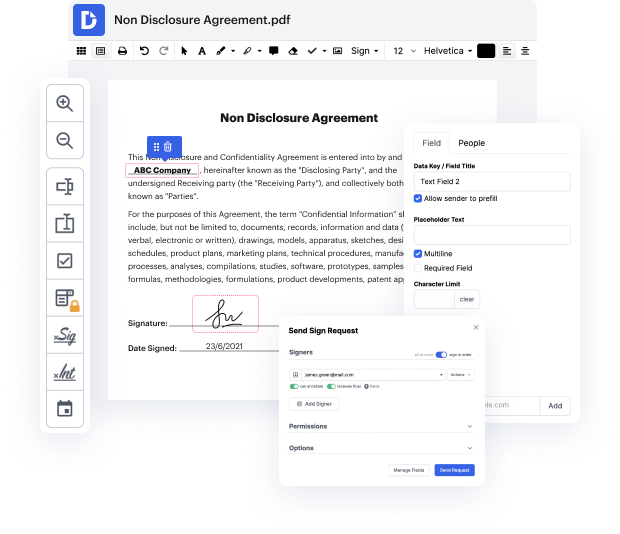

The challenge to handle Hotel Receipt can consume your time and effort and overwhelm you. But no more - DocHub is here to take the effort out of editing and completing your papers. You can forget about spending hours editing, signing, and organizing papers and worrying about data security. Our platform provides industry-leading data protection measures, so you don’t need to think twice about trusting us with your privat data.

DocHub supports various data file formats and is available across multiple systems.

hey its tax quips time from tax mama.com today tax Mama hears from Tim in the Tax quips Forum with this question he says a relative was sent by his company to work far away from home in different places for weeks at a time he was given a non-accountable predum that was included in box one of his W2 he didnt save the hotel receipts from his stays though he does know to save them now he does have his monthly CR credit card statements that show him paying Motel 6 in various cities looks like the IRS wants itemized hotel receipts in order to split food from lodging but all his stays were at Motel 6 which does only lodging and no food can he still include lodging in his employee expense deduction with what he has oh yes Tim I would definitely includeed all is he being audited if not he doesnt have any worries at this time true Motel 6 doesnt offer services like Neils so if hes got everything on credit cards and has a calendar showing what city he worked in each week hell be fine howe